CRYPTOCURRENCY AND MONEY LAUNDERING - CONGRESS UNDER PROPOSED NEW REGULATORY REGIMES TO BETTER PROTECT THE PUBLIC INTEREST/ REINFORCE GLOBAL FINANCIAL SYSTEM

ORLANDO, FLORIDA / AGILITYPR.NEWS / March 09, 2023 / CRYPTOCURRENCY AND MONEY LAUNDERING OVERSIGHT - US CONGRESS AND AGENCIES ENACTING NEW CONTROLS AND ACCOUNTABILITY FOR BETTER TRANSPARENCY, PRIVACY AND SECURITY TO REINFORCE GLOBAL FINANCIAL SYSTEM

Digital Assets for Better Support Competition and Technology Innovation in the Capital Markets

Executive Summary

Call to Action - American policy leaders come together (bipartisan) a to legislate crypto regulatory oversight as soon as possible to create a robust, comprehensive, consistent crypto regulation and supervision that is also global in operation. We know, a number of emerging market and developing economies (countries) are already materially affected by crypto risks. Some of these countries are actively entering currency substitution through, crypto assets, primarily dollar-denominated stablecoins - substituting their domestic currency and assets, and circumvent exchange and capital control restrictions (LIKE RUSSIA). Such crypto substitution is creating capital outflows, a loss of monetary sovereignty, and threats to financial stability, creating new challenges for US and global financial policy makers. America and other countries like the EU (Free Countries of the world) need to address the root causes of #cryptoization, by improving trust in their domestic economic policies, currencies, and banking systems. Cross-border nature of crypto limits the effectiveness of uncoordinated national approaches to mitigate systemic risk as digital currency continues to grow without critical controls, accountability, transparency - like FTX blow-up. For a global approach to work, countries like America must also be able to adapt to a changing landscape and risk outlook and work with countries from a global crypto regulatory framework ASP.

WHY/ STAT: According to CNBC, the best-known cryptocurrency, Bitcoin, had a good year. The digital currency has been up nearly 70 percent since the start of 2021, driving the entire crypto market to a combined $2 trillion in value.

ANALOGY: "If it looks like a duck, walks like a duck and quacks like a duck..." - Gary Gensler from US SEC: "These are the same rules that everyone else in the securities markets has played by for decades." Why not institute same disclosures, have internal controls, conduct audit, provide assurance, conduct attestation, provide insurance AND grow innovation, expand growth potential for future generations/ new technologies/ blockchain/ XBRL/ data tagging/ GLEIF for regulatory oversight?

BACKGROUND

In early May, 2023 - the federal jury just returned a guilty verdict in what has been referred to as the first “insider trading” conviction involving NFTs. But, rather than charge insider trading, the U.S. Attorney’s Office actually relied on wire fraud and money laundering charges, which avoided the question of whether the NFTs constituted securities. Further > Conviction was not based on trading in any security or commodity -- prosecution argued that the form of its CONFIDENTIAL BUSINESS INFORMATION regarding which NFTs would be featured on OpenSea’s homepage because OpenSea employees were OBLIGED to keep this information confidential and use it only for the benefit of OpenSea -- conduct defrauded OpenSea of its property, i.e., its confidential business information.

MEANWHILE in the Coinbase legal case, the SEC filed a parallel complaint, which did allege that the trading violated Section 10(b) of the Exchange Act and Rule 10b-5 thereunder and will turn on whether the crypto assets are securities. Per this article from Proskauer, there the defendants argue that secondary market trades involving crypto tokens are not securities transactions, even if the tokens were investment contracts at issuance, since there are “no binding promises running from the developers to the tokenholders.”

OBVIOUSLY LEGAL CONFLICT REQUIRES QUICK CONGRESSIONAL ACTION IS REQUIRED IN A BIPARTISAN MANNER TO HELP RESOLVE A NATIONAL CRYPTO REGULATORY OVERSIGHT FRAMEWORK TO BOTH PROTECT INVESTORS AND ALSO PROVIDE INNOVATIVE MEANS TO PROMOTE DIGITAL ASSETS TO SUPPORT A THRIVING CAPITAL MARKETS TO BETTER MANAGE RISK BUT SUPPORT OPPORTUNITY? INNOVATION.

Summary:

Late last year cryptocurrency markets fell rapidly when FTX was identified as a fraudulent actor. Its main banking partner, Silvergate, served as one of the most recognized crypto firms — but when it began to experience a credit and liquidity deadlines, depositors left en masse and loan markets began to dried up. Silvergate Exchange Network — was shuttered and the crypto-friendly bank moved to voluntarily liquidate on March 9. On March 11, 2023 - Regulators shut down Silicon Valley Bank in biggest collapse since 2008 financial crisis - Second largest bank failure in US history pegged in December 2022 at $109 Billion in assets. Stablecoin USDC breaks dollar peg after revealing $3.3 billion Silicon Valley Bank exposure. NYT: “There’s no crypto regulator insuring accounts for $250,000,” said Danny Moses, an investor at Moses Ventures who is known for his role in predicting the 2008 crisis in “The Big Short.” The second bank collapse occurred on March 12: Signature Bank in New York. Just like Silvergate, Signature was a large provider of banking for cryptocurrency companies. On this same day - March 12, 2023 - In a first, instead of the FDIC moving in to takeover the bank, a statement was issued jointly with the Fed and Treasury, ensuring all deposits at SVB and at Signature Bank would be covered including cryptocurrency. Several other banks maybe suffering from the impact of "crypto banking risks" for other local California banks working with clients similar at SVB and Signature Bank -- but Treasury and FDIC have taken direct efforts to mitigate crypto systemic risks and enforcement agencies like the US Securities & Exchange Commission is coming down hard to do their work within the bounds of the law.

As Gary Gensler, US SEC stated recently: "Crypto intermediaries should structure their businesses to comply with our laws governing securities exchanges, broker-dealers, and clearinghouses; they could put into place rulebooks that protect against fraud and manipulation. Crypto security issuers should file registration statements and make the required disclosures. These are the same rules that everyone else in the securities markets has played by for decades."

On April 14, 2023 - The U.S. Securities and Exchange Commission met on Friday to open public comment again on its proposal to expand the definition of an "exchange," clarifying that its existing rules on exchanges also apply to decentralized cryptocurrency platforms.

Update in the EU:

On Apr 20, 2023 the EU Parliament endorsed new regulations on markets in crypto-assets (#MiCA) against money laundering and terrorist financing with MEPs set to negotiate the final shape of the legislation with EU governments. The regulation would establish harmonised rules for crypto-assets at EU level, thereby providing legal certainty for crypto-assets not covered by existing EU legislation.

This study is one of several discussing whether the proposed #MiCA #Regulation will create legal certainty, allowing for the increased adoption of crypto-assets to support the capital markets. Will the United States follow a similar approach to cryptocurrency?

Update: United States Federal Regulatory Cryptocurrency Initiatives Underway:

Meanwhile, US Congress is now underway to quickly create cryptocurrency legislative oversight and various federal agencies are agreeing to come together to protect investors but nevertheless efforts are needed to avoid bad players and fraudsters in cryptocurrency and digital assets more than ever.

According to Coindesk on April 28 - The U.S. House Financial Services Committee and House Agriculture Committee will put together legislation to oversee the crypto sector in the "next two months" after holding joint public hearings starting in May, said Rep. Patrick McHenry (R–N.C.), chair of the House Financial Services Committee. When asked whether such a bill could be signed by President Joe Biden in the next 12 months, McHenry told a crowd at CoinDesk's Consensus 2023 event, "yes." The key lawmaker was quick to provide a rider that it's always a challenge to legislate something new into existence. "What we plan to do over the next two months is report a deal out," McHenry said. He added that the bill will address both securities and commodities regimes and issues that are hard to fix on either side.

US Senate Banking Side:

With rising crypto regulation/oversight, governance, and money-laundering/fraud issues -- bipartisan legislation is pending before Congress to create a NATIONAL CRYPTOCURRENCY regulatory regime contained in provisions of The Digital Asset Anti-Money Laundering Act on the US SENATE SIDE:

Key US Senate Cryptocurrency Provisions Under Review Include:

- Extend Bank Secrecy Act (BSA) responsibilities, including Know-Your-Customer requirements, to digital asset wallet providers, miners, validators, and other network participants that may act to validate, secure, or facilitate digital asset transactions by directing FinCEN to designate these actors as money service businesses (MSBs).

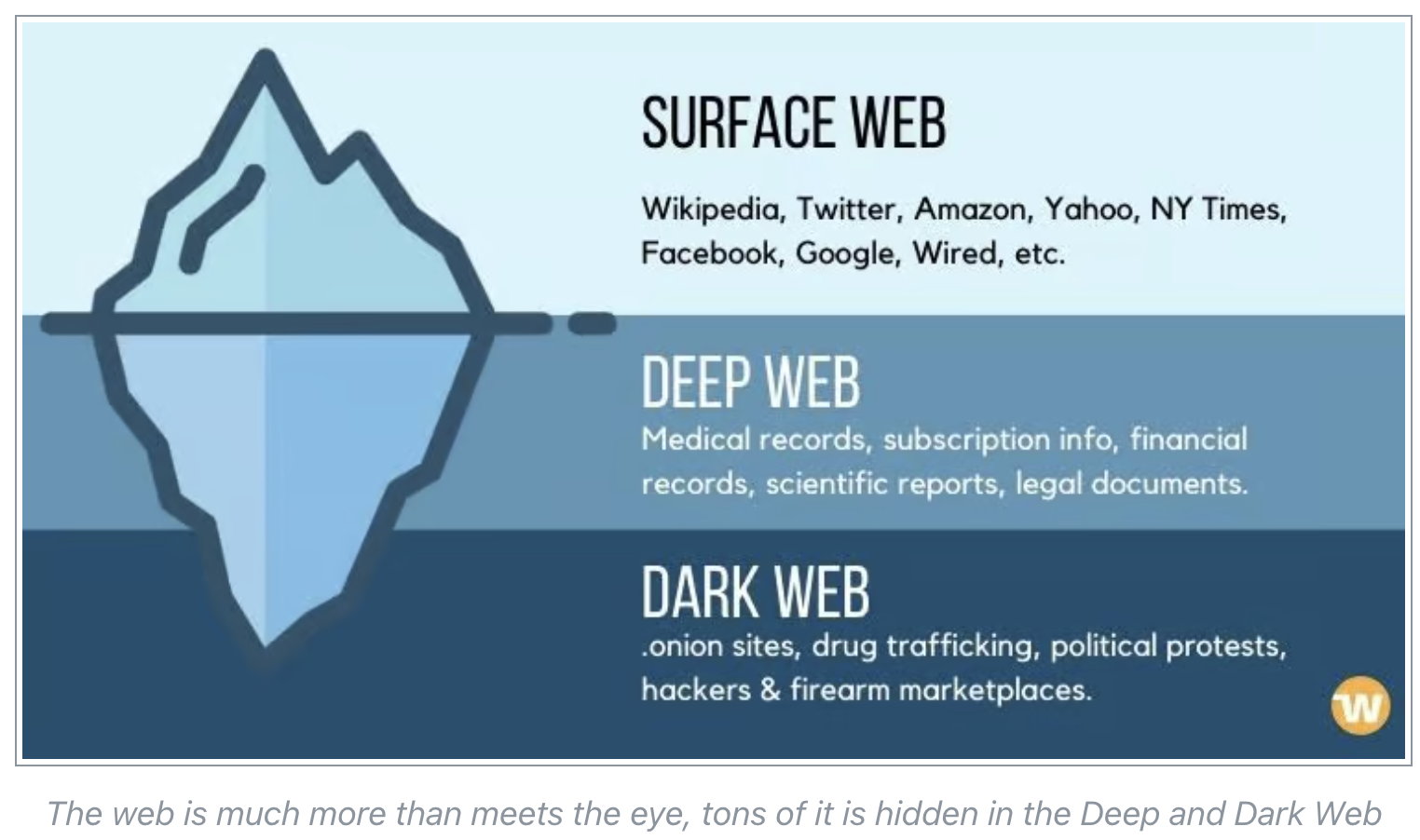

- Address a major gap with respect to “unhosted” digital wallets – which allow individuals to bypass AML and sanctions checks – by directing FinCEN to finalize and implement its December 2020 proposed rule, which would require banks and MSBs to verify customer and counterparty identities, keep records, and file reports in relation to certain digital asset transactions involving unhosted wallets or wallets hosted in non-BSA compliant jurisdictions.

- Prohibit financial institutions from using or transacting with digital asset mixers and other anonymity-enhancing technologies and from handling, using, or transacting with digital assets that have been anonymized using these technologies.

- Strengthen enforcement of BSA compliance by directing the Treasury Department to establish an AML/CFT compliance examination and review process for MSBs and directing the Securities and Exchange Commission and Commodity Futures Trading Commission to establish AML/CFT compliance examination and review processes for the entities it regulates.

- Extend BSA rules regarding reporting of foreign bank accounts to include digital assets by requiring United States persons engaged in a transaction with a value greater than $10,000 in digital assets through one or more offshore accounts to file a Report of Foreign Bank and Financial Accounts (FBAR) with the Internal Revenue Service.

- Mitigate the illicit finance risks of digital asset ATMs by directing FinCEN to ensure that digital asset ATM owners and administrators regularly submit and update the physical addresses of the kiosks they own or operate and verify customer identity.

International Oversight:

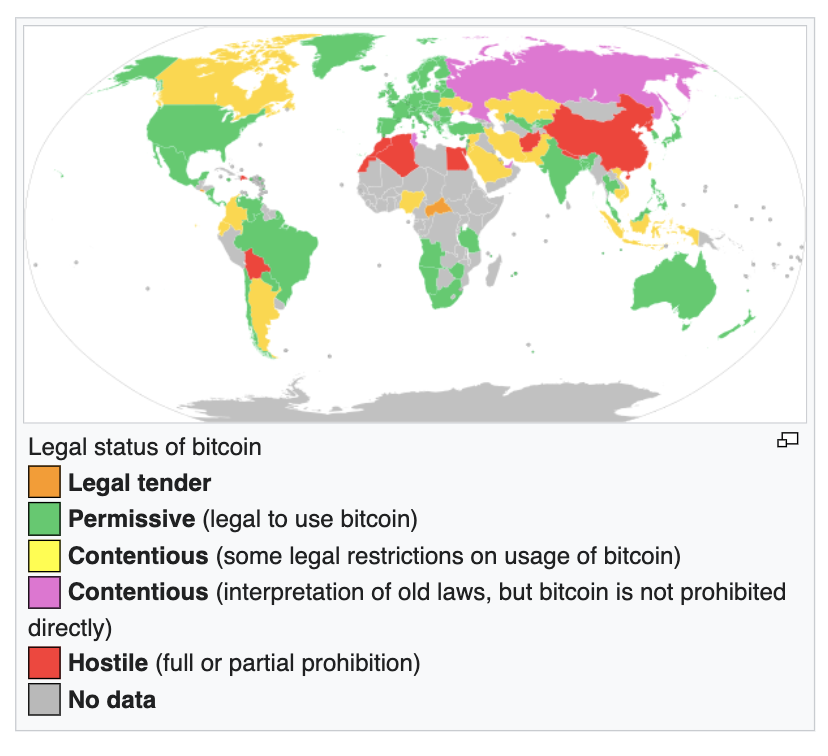

International - Legality of cryptocurrency by country or territory Overview of : The legal status of cryptocurrencies varies substantially from one jurisdiction to another, and is still undefined or changing in many of them.[1] Whereas, in the majority of countries the usage of cryptocurrency isn't in itself illegal, its status and usability as a means of payment (or a commodity) varies, with differing regulatory implications.[2] SEE MAP BELOW REGARDING CRYPTOCURRENCY OVERSIGHT

Why Congress Needs Bipartisan Efforts Now for Cryptocurrency Governance/ Regulatory Oversight and Prevents of Bad Players/Fraudsters to Better Protect Investors/ National Interest

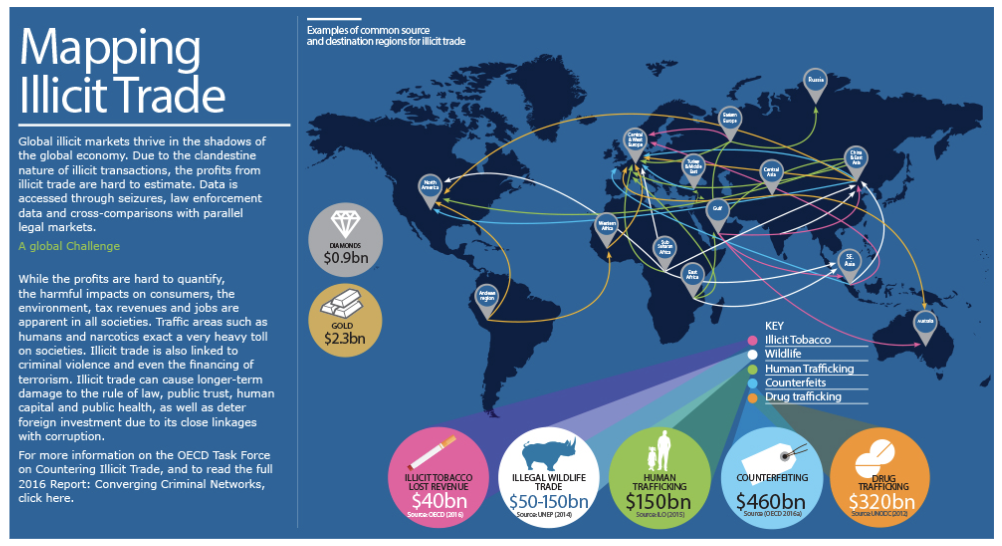

The volume of crime-related transactions increased from the second consecutive year, hitting an all-time high of $20.6 billion, blockchain analytics firm Chainalysis says in its new "Crypto Crime Report." And what we know is that 43% of all 2022’s illicit transaction volume came from activity associated with SANCTIONED ENTITIES (Like RUSSIA).

See Page 2 Below - Continued

Page 2 Continued:

So where do we stand in the United States regarding cryptocurrency oversight and efforts to prevent Russia and other sanctioned countries?

In 2021, the Federal Bureau of Investigation’s (FBI) Internet Crime Complaint Center received a record number of cybercrime complaints, over 840,000, with potential losses exceeding $6.9 billion. According to the FBI, these complaints address a wide array of internet-enabled scams affecting victims across the globe.

In addition, a new February 2023 Treasury Report reveals that rogue nations like Iran, Russia, and North Korea have used digital assets to launder stolen funds, evade American and international sanctions, and fund illegal weapons programs. In 2021, cybercriminals raked in at least $14 billion in digital assets – an all-time high. Binance, the world's-largest crypto platform, was reported to have laundered over $10 billion for criminals and sanctions evaders over the last few years.

According to US Senator Elizabeth Warren regarding the Treasury Report – “More evidence that crypto is the currency of choice for illicit finance—including by Russians looking to evade sanctions. Senator Warren is proposing a bipartisan bill that would crack down on rogue states and criminals using crypto to move dirty money.”

Why Russia and Criminals Are Using Cryptocurrencies of Choice Now?

Why -- because cryptocurrencies can make it easier for criminals to hide their source of payoffs and are moving to the preferred digital assets of choice – buying illicit items and services using Bitcoin as a payment method to ransomware attacks where payments are demanded. This trend is more prevalent because cryptocurrency offers both anonymity AND ease of use the opportunity to counter-act and elude international borders and regulations – and use crypto money laundering to avoid ill-gotten payoffs.

According to the US Secret Service - The term digital assets refers broadly to representations of value in digital form, regardless of legal tender status. For example, digital assets include cryptocurrencies, stablecoins and nationally backed central bank digital currencies. Regardless of the label used, or the various definitions ascribed to them, digital assets can be used as a form of money or be a security, a commodity or a derivative of either. Digital assets may be exchanged across digital asset trading platforms, including centralized and decentralized finance platforms, or through peer-to-peer technologies.

So where do we stand in the United States regarding cryptocurrency oversight and efforts to prevent Russia and other sanctioned countries?

Right now, a FEDERAL (NATIONAL) cryptocurrency legislation is “In Process” because finding a consistent “legal approach” on each state level for regulatory oversight .

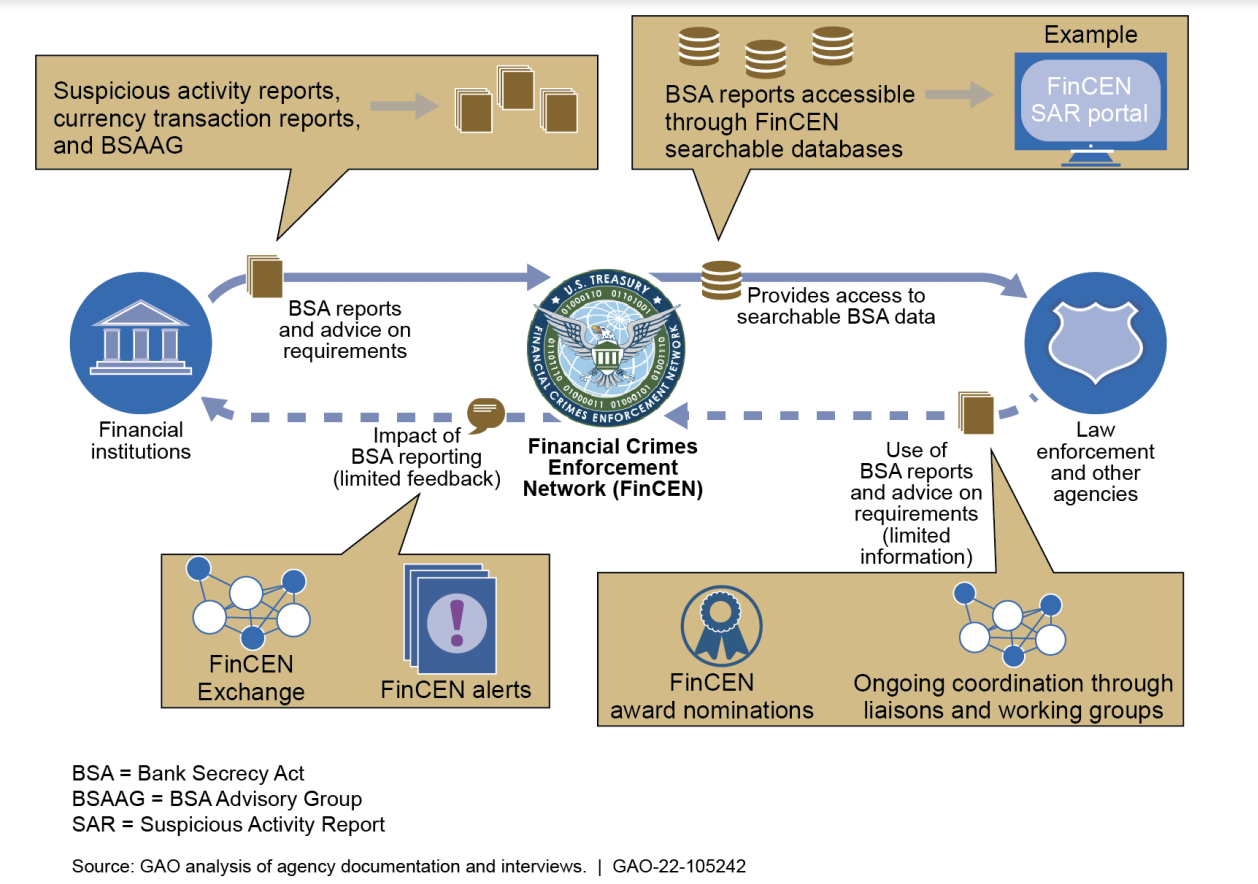

The US Treasury Department’s Financial Crimes Enforcement Network (FinCEN) has been policing criminal cryptocurrency for many years. But FinCEN does not review cryptocurrencies to be legal tender but considers cryptocurrency EXCHANGES to be money transmitters on the basis that cryptocurrency TOKENS are “other value that substitutes for currency.”

Crypto EXCHANGES that register as money transmitters are required to verify their customers’ identities. Warren’s bill would extend those kinds of responsibilities to other entities, including digital asset wallet providers and crypto miners.

The Internal Revenue Service (IRS) does not consider cryptocurrency to be legal tender but defines it as “a digital representation of value that functions as a medium of exchange, a unit of account, and/or a store of value” and has issued tax guidance accordingly.

What we know about Crypto Exchanges:

Cryptocurrency exchanges are legal in the United States and fall under the regulatory scope of the Bank Secrecy Act (BSA). Under law, this means that cryptocurrency exchange service providers must register with FinCEN, implement an AML/CFT program, maintain appropriate records, and submit reports to the authorities. Meanwhile, the US Securities and Exchange Commission (SEC) has indicated that it considers cryptocurrencies to be securities, and applies securities laws comprehensively to digital wallets and exchanges by proposed changes would mandate custodians, including CRYPTO EXCHANGES, to secure or maintain certain federal or state registrations, even as regulators are both increasing scrutiny on crypto companies and making it more difficult to secure regulatory approval for CRYPTO PRODUCTS By contrast, The Commodities Futures Trading Commission (CFTC) has adopted a friendlier, “do no harm” approach, describing Bitcoin as a commodity and allowing cryptocurrency derivatives to trade publicly.

According to the US Department of Justice and the FBI - While the United States has been a leader in setting standards for regulating and supervising the use of digital assets for anti-money laundering and countering the financing of terrorism purposes, poor or nonexistent implementation of those standards in some jurisdictions abroad is presenting significant illicit financing risks that harm the American people and our foreign partners. For example, transnational organized criminals often launder and cash out their illicit proceeds using digital asset service providers in jurisdictions that have not yet effectively implemented international standards.

Stay tuned at both national and international efforts related to cryptocurrency and anti-money laundering efforts which includes news accounting, audit, internal controls ensuring that companies keep track with new innovative technological developments and on supply chain governance and on business conduct to better support the capital markets protect investors.

#cryptocurrency #bitcoin #crypto #blockchain #ethereum #btc #forex #money #trading #investment #bitcoinmining #cryptotrading #cryptonews #investing #bitcoins #business #bitcoinnews #internalcontrols #cryptocurrencies #forextrader #invest #entrepreneur #eth #bitcointrading #trader #investor #binaryoptions #forextrading #bitcoincash #finance #usa #business #Enterpreneur #success #money #investment #millionaire #wealth #accounting #audit #ExternalAuditors #InternalAudit #Infrastructure #CFTC #FDIC #federalreserve #fhfb #occ #Treasury #FBI #BSA #aml #gleif #iosco #ifac #iasb #ifrsfoundation #ifrs #fasb #oversight #law #abaesq #personalfinance #forensicaccounting #sec #ussec #oecd #FT #bloomberg #reuters #usdoj #usdol #banking #financialservices

#cryptocurrency #bitcoin #crypto #blockchain #forex #money #trading

#cryptoexchange #esma #ecb #esef #xbrl #corpgov #sox404 #internalcontrols

#investment #bitcoinmining #systemicrisk #cryptonews #investing #banking

#cryptocurrencies #forextrader #invest #entrepreneur #bitcointrading #trader

#investor #fdicia #bitcoincash #finance #usa #business #entrepreneur #success #money

#investment #millionaire #wealth #invest #fintech #regtech #ai #dataanlaytics

#blockchain #banking #financialservices #currency #forensicaccountant #trading #internalcontrols #cryptocurrency #investing #finance #forextrader #financialfreedom #crypto #investor #drugmoney #blockchain #governance #government #politics #svb

#leadership #internalaudit #esma #forensicaccountant #treasury #ukfca #euparliament #frankfurt #currentaffairs #drugcartel #riskmanagement #ethics #environment #crime

#compliance #economy #goodgovernance #covid #svb #internationalrelations #ftx

#education #sustainability #putin #innovation #history #auditcommittee

#opengoverment #democracy #sox404 #russia #social #polity #innovation #bsa #esg #csr #fraud #oversight #homelandsecurity #drugmoney #scotlandyard #oecd #ifac #pcaob #usdol #ebsa

#corporategovernance #policy #ransomware #security #law #aml #society #publicinterest

#corpgov #cfo #ceo #board #usdod #director #internalcontrols #materialrisk #madoff #accounting #sec_news #ponzischeme #ima #pryamid #svb #gambling #eu #ukraine #taxes #fbi #interpol #ima_news #audit #attestation #fintech #regtech #govtech #accountability #transparency

#aml #bsa #humantrafficking #childlabor #abaesq #employmentlaw #bank

#personalfinance #supplychain #usdoj #gleif #lei #stocks #coinbase #xrp #forextrading #dogecoin #binaryoptions #bitcoinprice #cryptoworld #cryptoinvestor #forexsignals #stockmarket #altcoin #hodl #nfts #ripple #motivation #cryptoart #success #blockchaintechnology #cryptomining #wealth #nftart #usgao #mining #cybersecurity #binary #firstrepublic #altcoins #financialfreedom #trade #art #usa #forexlifestyle #crypto #usa #business #entrepreneur #cryptotax #success #money #bitcoin #forex #investment #millionaire #wealth #invest #trading #cryptocurrency #investing #ifc #finance #forextrader #financialfreedom #investor #blockchain #cia #altcoin #usdol #bitcoinexchange #fdic #dogecoin #altcoins #blockchaintechnology #cryptoworld #cryptomining #cryptocurrencynews #cryptomarket #cryptomemes #cryptolife #cryptotrader #cryptos #cryptocurrencytrading #cryptotrade #cryptozoology #cryptomeme #cryptoexchange #cryptocurrencies #cryptotrading #cryptonews #cryptoworld #cryptomining #cryptocurrencynews #cryptomarket #cryptomemes #cryptolife #cryptotrader #cryptos #cryptocurrencytrading #cryptotrade #cryptozoology #cryptoexchange #cryptomoney #cryptocoin

About Us

COLCOMGROUP

Accomplished business development, government affairs, media relations, strategic relations, marketing, branding and communications executive with experience in accounting, legal, consumer goods, financial services, technology and professional services sectors.

Counsel clients in variety of areas: global private placement advisory services, capital fundraising, debt/equity financing, sponsorship, CSR/ESG advisory services, LGBTQ diversity, equity and inclusion, strategic planning, new product development, product launches, direct marketing, collateral and advertising design, copy writing/writing, speech writing, business plan/marketing plan/communications plan development, product/service positioning and branding, media relations, government affairs, media training, message point development, image management, new business development, and strategic partner development/third party outreach. Cancer survivor and advocate.

We speak regularly to professionals on marketing and communications topics. Specialties include:

- Media Relations

- Marketing

- Branding

- Positioning

- Business Development

- Government Affairs

- Message Development

- Image Management

- Issues Management

- Strategic Planning

- Product Development

- Product Launches

- Strategic Partner Development

- Human Capital / Diversity, Equity and Inclusion

- LGBTQ Diversity, Equity and Inclusion

- Cybersecurity

- Cryptocurrency

- Forensic Accounting

- White Collar Crime Issue

- Sponsorship Sales

- Membership Marketing

- Human Capital Disclosures

- Financial & Non-Financial Reporting Standards

- ESG Corporate Disclosures - Climate / Human Capital

- CPE Marketing

- Big Data/ Data Analytics

- iXBRL

- Crowd Funding/Sourcing

Contacts

David Colgren

CEO- Colcomgroup

dcolgren@colcomgroup.comPhone: 9175873708

https://www.linkedin.com/in/davidcolgren/