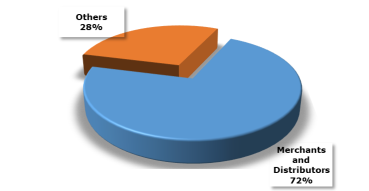

Estimated 72% of commercial washroom products distributed via trade channels

UK / AGILITYPR.NEWS / October 17, 2019 / AMA Research estimate that 72% of commercial washroom products are distributed via trade channels, these can be defined as builders and plumber’s merchants as well as distributors. This evaluation is taken from the 7th edition of the Commercial Washrooms Market Report UK. A report which also examines in detail the main product sectors of the commercial washrooms market, market sizes and product trends. Also reviewed within the report are key commercial end-use application sectors, such as education, healthcare, entertainment & leisure, offices, infrastructure, retail and industrial.

The trend of the online retailer seems to have not yet broken into the commercial washroom sector. Where online and other retail channels have grown within the domestic bathroom market, the commercial washroom market continues to be largely dominated by the builders and plumbers’ merchants as well as bathroom distributors. It could be postulated that this could be caused by legislative and regulatory requirements and an aging UK population.

The builders and plumbers’ merchants’ market is dominated by 4 major merchant organisations. Because of this, smaller companies, especially those with limited financial resources, have found it difficult to survive. With key factors affecting the market such as Brexit and the impact this may have on the overall UK economy, as a result, they have easily become acquisition targets for larger companies.

The performance of the commercial washroom market is heavily influenced by trends within the non-residential construction sector. The idea of using branded goods from leading manufacturers that we have seen across other sectors is now becoming more popular with the commercial washroom marketplace. It is understood that this is an endorsement of quality. Own label products remain a cost-effective option for the more price conscious end of the market. The dominant 4 merchant organisations will therefore be able to cover both ends of the market due to having the lion’s share of the marketplace.

While the ‘other’ 28% are made up form direct sales, traditional retail and online retail specialist, the main 72% are able to keep a grasp on the market by ensuring that they also hold their own online presence. All the while noting that these types of products – baths, sanitaryware, brassware, showers & mixers and washroom panel systems - tend to be needed to be professionally installed, meaning that the tradespeople employed will more than likely go to the merchants and distributors rather than the ‘others’ within the marketplace, keeping the builders and plumbers merchants and distributors firmly within the majority section for the foreseeable future.

The information was taken from ‘Commercial Washrooms Market Report – UK 2019-2023’ by AMA Research, which is available to purchase now at www.amaresearch.co.uk or by calling 01242 235724.

About Us

About AMA Research

AMA Research is a leading provider of market research and consultancy services with over 25 years’ experience within the construction and home improvement markets. For more information, go to www.amaresearch.co.uk or follow us on Twitter @AMAResearch for all the latest building and construction market news.

Since 2017, AMA Research has been part of Barbour ABI, a leading provider of construction intelligence services. Barbour ABI is part of UBM, which in June 2018 combined with Informa PLC to become a leading B2B information services group and the largest B2B Events organiser in the world. To learn more and for the latest news and information, visit www.ubm.com and www.informa.com.

Contacts