AI in Medical Imaging Diagnostics: Benchmarking 60+ Companies

CAMBRIDGE, UK / AGILITYPR.NEWS / July 29, 2020 / Deep learning has revolutionized image recognition and analysis, making unprecedented performance leaps between 2010-2014. These rapid advancements enabled the development of automated, accurate, accessible, and cost-effective medical diagnostics. Over 60 entities including 40 new firms globally have set out to capitalize on these technological advances, seeking to commercialize AI-based diagnostics services in fields such as cancer and cardiovascular disease (CVD). IDTechEx forecasts the market for AI-enabled image-based medical diagnostics to exceed $3 billion by 2030.

In this article, IDTechEx examines the future market for image recognition AI in medical diagnostics. The article considers the progress thus far and assesses how each segment of the market is likely to evolve. Next, it considers the competitive landscape, examining investment patterns by disease area, company readiness levels by application, and the trends in focus areas. Finally, it provides an outlook about the future of this market.

This article draws from the brand new IDTechEx report, “AI in Medical Diagnostics 2020-2030: Image Recognition, Players, Clinical Applications, Forecasts”. It develops detailed quantitative benchmarks and examines the real status of technological capabilities today. It provides realistic roadmaps, showing what challenges the technology faces and how it is likely to evolve. Furthermore, it analyses the competitive landscape, identifying and reviewing more than 60 companies and leading research institutes. The strengths of the companies’ technology are benchmarked, as well as their product positioning, value proposition, and more.

Finally, it estimates and forecasts the total addressable market per disease type in scan volume. It provides realistic market penetration and cost evolution projections per disease type, as well as segmented market forecasts in scanned volume and market value. The details of IDTechEx’s findings can be found here www.IDTechEx.com/IRAI.

The Rise of Image Recognition AI in Medical Diagnostics

The use of image visualization and limited recognition software in medical diagnostics started over 20 years ago. This technology had however nearly reached its performance limits when deep learning (DL) and convolutional neural networks (CNNs) were developed, heralding a step-change in the capability and performance of machine vision.

This progress demonstrates that image recognition AI technology can match or even exceed human-level performance (in terms of accuracy, sensitivity, and specificity) in many disease areas and on many imaging modalities. The technical threshold for the automation of these diagnostic tasks has already been reached, laying the groundwork for commercial growth in the short and long term.

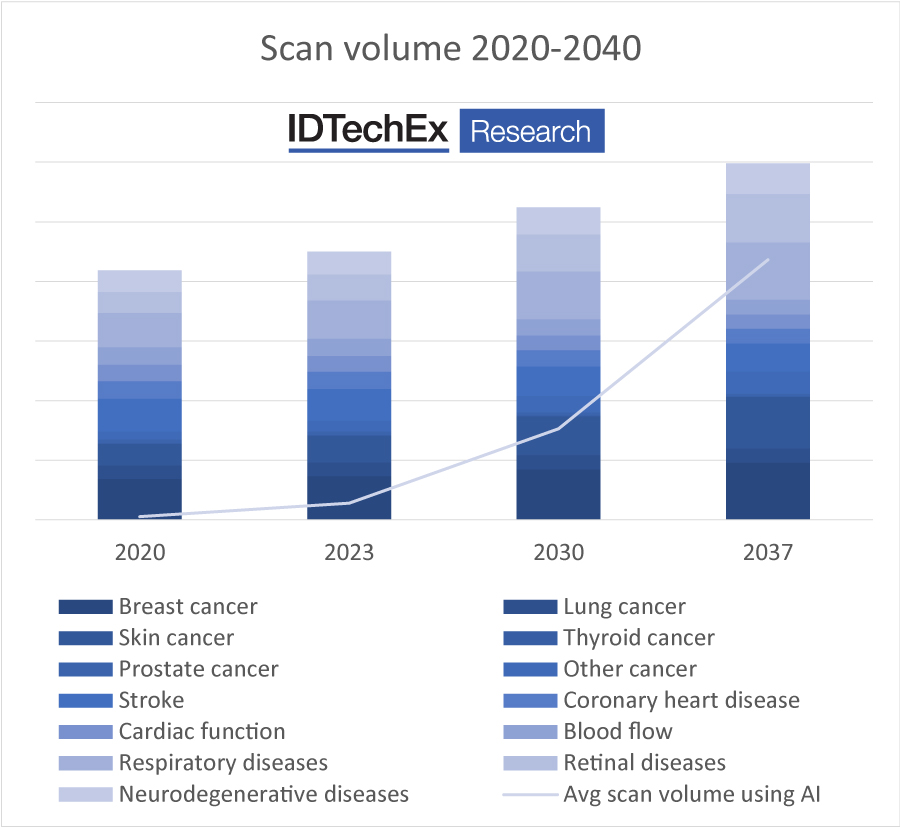

This is shown in the market projections below. Here, the bars represent estimates and growth forecasts from IDTechEx for total scan volumes per disease type. This is essentially the addressable market for AI. Note that accelerated growth in scan volumes can be expected when the AI is widely available and when the imaging equipment itself is low cost – e.g., RGB camera vs CT or MRI scanner.

The continuous line shows market penetration forecasts. The chart shows the average value weighted across all disease categories. In its report, IDTechEx has developed a different penetration curve for each segment, reflecting the state of technological readiness, clinical testing stage, the added value over existing methods, and so on.

Note that AI algorithms are already deployed with notable volumes. Nonetheless, an inflection point – as an average across all categories- is expected to occur around 2023-2024. All in all, AI usage in medical image diagnostics is anticipated to grow by nearly 10,000% until 2040 whilst the global addressable market (scan volumes regardless of processing method) will grow by 50%.

For a detailed segment-by-segment analysis, please visit www.IDTechEx.com/IRAI.

Source: IDTechEx Research - “AI in Medical Diagnostics 2020-2030: Image Recognition, Players, Clinical Applications, Forecasts”

Company Landscape Segmentation: Target Markets and Geography

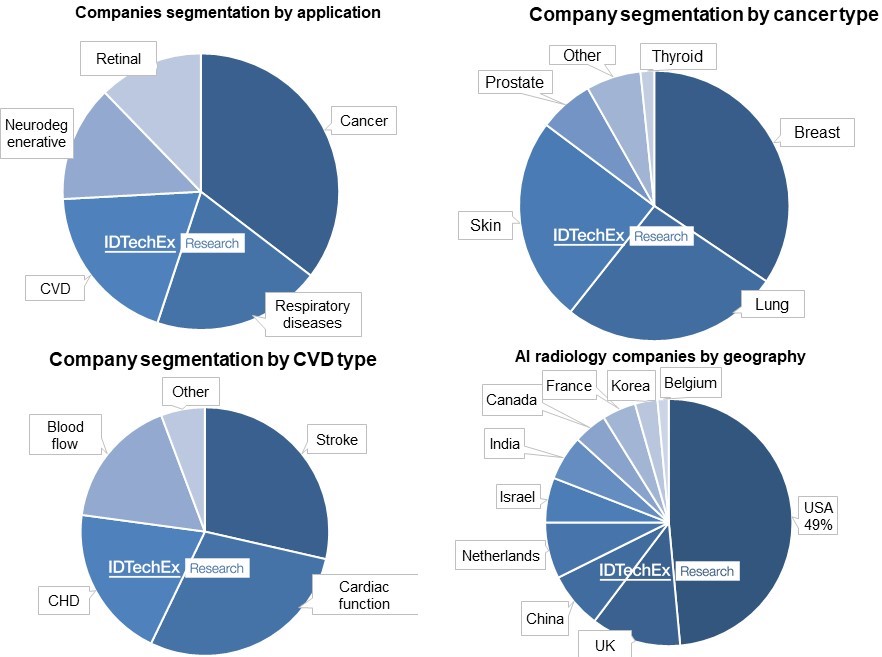

Given the high growth potential of image recognition AI, it is no surprise that competition in this market is heating up. The pie charts below show how the competitive landscape currently segments in terms of focus area and geography.

Source: IDTechEx Research - “AI in Medical Diagnostics 2020-2030: Image Recognition, Players, Clinical Applications, Forecasts”

The most active and crowded market for image recognition AI, in terms of the number of players, is cancer. The value-added – be it in accelerating triage or in improving diagnostic - is very high, as early and accurate detection is vital to maximizing chances of survival.

Within this category, breast, lung, and skin cancer have been the main focus. Here, the high prevalence and relatively simple and fast image acquisition equipment creates high scan volumes, which in turn results in large demand.

These spaces are becoming increasingly crowded. Companies must move well beyond just meeting the minimum technical milestones to compete in these markets. Many have already passed clinical trials for specific algorithms. This is thus a prerequisite, but not a point of differentiation.

Respiratory diseases and CVD each make up about a fifth of the company landscape. Interestingly, COVID-19 provided a boost for firms active in respiratory diseases. This is because COVID-19 detection is largely based on algorithms built for respiratory disease detection. Companies in this sector were quick to adapt their existing software to detect signs of COVID-19 as it provided them publicity at a time when overwhelmed hospitals were desperate for any kind of support.

In terms of geography, the USA is undoubtedly emerging as the central hub of medical image recognition AI technology. The annual scan volume in the USA per 1000 population is 3-5 times higher that of other countries. This, and the generally higher prices, make this an attractive market.

More details are available in the brand new IDTechEx report, “AI in Medical Diagnostics 2020-2030: Image Recognition, Players, Clinical Applications, Forecasts”.

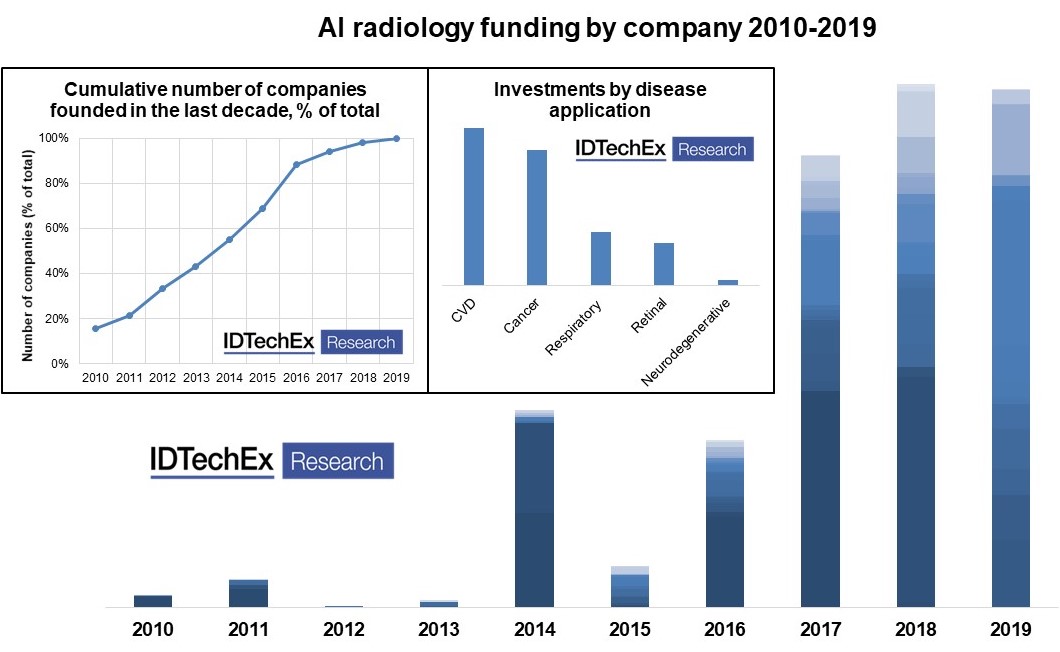

Money Is Flowing in as Over $2.2 Billion Have Been Invested to Date

Interest in image recognition AI technology in medical diagnostics has soared in the last decade and this is reflected by the level of investments it has generated. Combined investments since 2017 are over 200% higher than the total since the start of the decade. IDTechEx found that total funding exceeds $2.2 billion. This figure mainly accounts for start-ups and medium-sized companies and excludes key players such as Google and Microsoft, for which the funding for AI radiology projects is excluded.

Source: IDTechEx Research - “AI in Medical Diagnostics 2020-2030: Image Recognition, Players, Clinical Applications, Forecasts”

Differentiation, Scale, and the Fatal Perils of Being a Me-Too

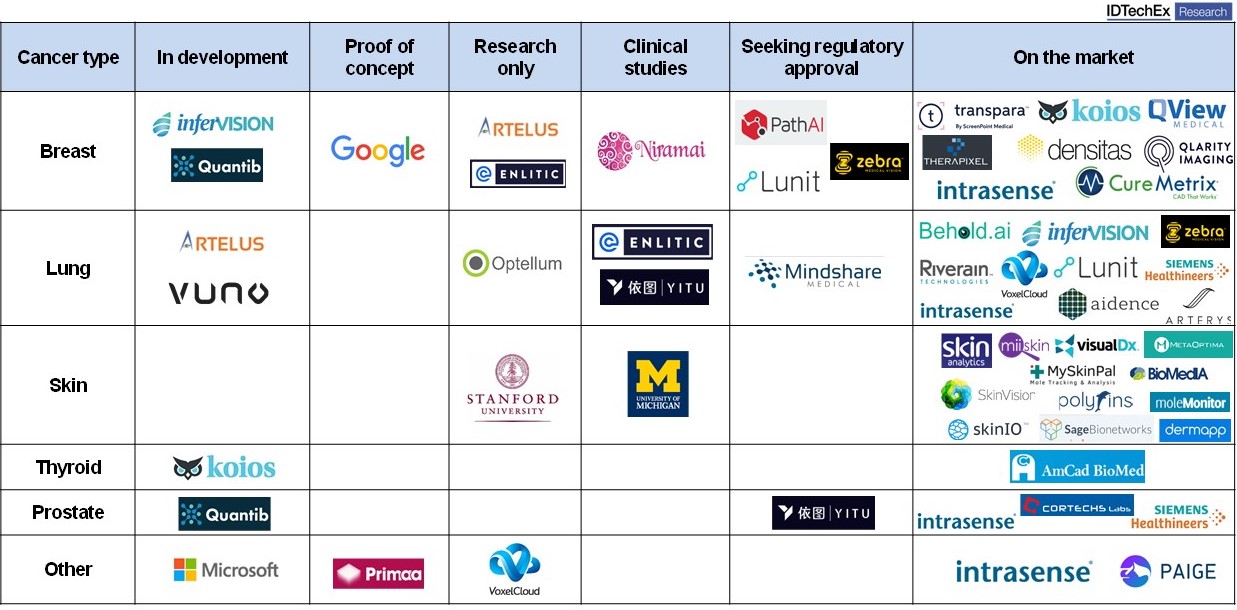

Each company, or each product of a company, sits at a different stage of readiness. The chart below provides a snapshot for commercialization stage in the cancer detection segment (note: those most advanced do not necessarily have the best or most wide-ranging technology).

Although multiple firms are already selling, this alone does not guarantee success. Companies are trying one or multiple of the following approaches to succeed:

• Towards wider applicability: The days of leaps in performance of image recognition are over, barring radical innovation in algorithm techniques. The gains in precision, recall and other metrics will henceforth be incremental. As such, the emphasis has shifted to other points. Of importance is showing that the AI is applicable to as wide a population set as possible.

This improves outcomes and widens market applicability. Whilst this requires no technological breakthrough, it is difficult to implement from execution, cost, and business model points of view. One needs to place a robust data acquisition and learning loop via partnerships and customer relationships at the heart of the product development. When successful, this will serve to erect moats around the business, acting as a large barrier to entry for newcomers. This will also serve as a filter separating out those who can evolve from a good tech story towards a viable business and those stuck at the tech demonstration level.

• Evolving beyond simple abnormality identification towards super-human insights: Whilst there is a spread in what different algorithms are offering, most are positioned as decision support tools. As a minimum, they need to detect (recognize + localize) the anomaly of interest. In some cases, they offer detailed pixel-level segmentation. The evolution is now to provide further information and explanations alongside object detection and instant segmentation. Some are even aiming to suggest treatment options, although this is generally further down the line. In short, the goal is to raise the AI complexity beyond object detection.

Furthermore, the algorithms today offer what humans do, but may do so faster and/or better, thus unleashing the automation wave. In the future, with more digitization of patient data, more data fusion can be expected, perhaps enabling AI to offer insights beyond human capability. This could be a game-changer.

• Scale: The IDTechEx view is that scale will matter in this business. This is because large scale, if done right, (a) means more access to data, which translates into an ever-widening performance gap against competitors in terms of algorithm accuracy, versatility, and applicability; (b) creates a one-stop-shop proposition, helping with the sales and customer acquisition process; (c) results in larger technical teams that can aid the on-site into-work-flow integration process, which in turn boosts installed base and acts a lock-in mechanism. In general, scale can help the winners drive consolidation.

Note that the elephant in the room here are the big software firms (Google and Microsoft). They have a big program on these topics but are yet, for various reasons, to take the plunge into this competitive landscape.

• Aggressive pricing: The pricing model right now is based on either a tiered subscription model or a pay per use. Few are also proposing a one-off fee. However, the amortized development costs and the installation fees resemble more like a fixed cost, whilst the supplier’s computing costs vary with the scanning volume so some type of per-use model will prevail. In general, the trend will be towards ever more competitive pricing. This is likely to be leveraged as a tool by well-funded organizations to force out smaller poorly capitalized competitors.

Source: IDTechEx Research - “AI in Medical Diagnostics 2020-2030: Image Recognition, Players, Clinical Applications, Forecasts”

The IDTechEx report, “AI in Medical Diagnostics 2020-2030: Image Recognition, Players, Clinical Applications, Forecasts”, provides a detailed analysis of most players operating in the medical image recognition AI space. It contains over 50 company profiles and examines the company landscape from both a commercial and technical standpoint. In-depth insights into current and upcoming technologies as well as detailed market analysis are also provided.

For more information on this report, please visit www.IDTechEx.com/IRAI or for the full portfolio of research available from IDTechEx please visit www.IDTechEx.com/Research.

About Us

IDTechEx guides your strategic business decisions through its Research, Consultancy and Event products, helping you profit from emerging technologies. For more information on IDTechEx Research and Consultancy, contact research@IDTechEx.com or visit www.IDTechEx.com.

Contacts

Links