BNPL sector set to drive global e-commerce value to $6trn by 2024

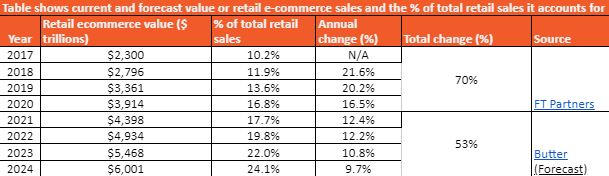

LONDON, UK / AGILITYPR.NEWS / July 28, 2021 / The retail e-commerce market is estimated to grow by 53% globally by 2024, with the Buy Now Pay Later (BNPL) sector expected to see the second-largest increase in market share, second only to mobile and digital wallets.

The latest figures show that the current size of the retail e-commerce market is $3.914trn (£2.833trn), having seen a 70% increase in just four years and now accounting for 16.8% of all retail sales.

While the annual rate of growth has slowed in recent years, British Buy Now Pay Later (BNPL) experts, Butter, estimate that the value of the e-commerce retail market will continue to climb by a further 53% by 2024 - bringing the total value to $6trn and accounting for nearly a quarter of all retail sales (24%).

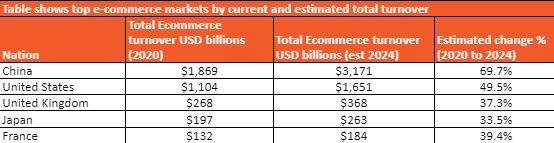

China is currently the world power where the e-commerce market is concerned, turning over $1.869bn and is expected to remain so with a 69.7% increase by 2024. The United States (49.5%) and the UK (37.3%) are also expected to maintain their current number two and three spots where e-commerce turnover is concerned.

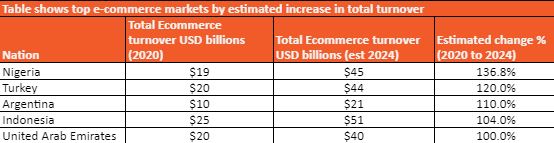

However, the sector is expected to see some even more notable increases across emerging markets in the coming years, with Nigeria (136.8%), Turkey (120%) and Argentina (110%) amongst the biggest increases.

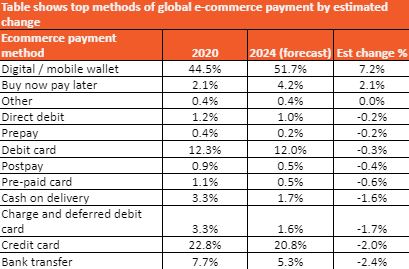

When it comes to the methods of payment expected to facilitate this steep rate of growth, just two are expected to increase in prominence - digital wallets and Buy Now Pay Later platforms.

Currently, digital and mobile wallets account for 44.5% of all e-commerce transactions, by far the most prominent method of payment. The BNPL sector currently accounts for 2.1%, with credit and debit cards, bank transfers, cash on delivery and deferred debit card charges accounting for a larger proportion of market share.

While digital and mobile wallets are predicted to remain the e-commerce payment method of choice with a 7.2% increase by 2024, the fast emerging BNPL sector is expected to leapfrog both cash on delivery and charge and deferred debit cards. With an estimated 4.2%, the BNPL sector is the only other payment method predicted to increase in prominence in the coming years.

Timothy Davis, Co-Founder and CEO of Butter, commented:

“Having seen such rapid growth in recent years, it’s only natural that the e-commerce market may start to see the annual rate of growth slow; More of us than ever before are transacting in this fashion, and therefore there are simply fewer new people to convert each year.

However, there is still plenty of growth left in the sector and while it will continue to dominate in already established markets such as China, the US and the UK, many emerging global markets are also due to see substantial increases.

This growth will also be driven by a generational shift as younger generations not only adopt this method of transacting as the norm but also look to emerging sectors such as Buy Now Pay Later for greater convenience when transacting.”

Download the Butter.co.uk app here

Search Butter Holidays here

Press Enquiries

James Lockett

M: 07584 248960

T: 0207 856 0185

E: james@properpr.co.uk

ProperPR

Data Enquiries

Alex Pericli

M: 07979 262393

T: 0207 856 0185

E: alex@properpr.co.uk

ProperPR

About Us

- Founded in 2017 by Timothy Davis, Stefan Hobl and Nik Haukohl. Butter achieved full FCA regulated status in 2017 prior to launch.

- Butter was the first BNPL lender to do so in the UK.

- Butter was also the first BNPL travel agent, enabling travellers to spread the cost of travel arrangements over time, with full payment not due until after the trip.

- Butter launched the first BNPL shopping app enabling customers to spread the cost of purchases from any online store.

- Butter has evolved into a British fintech platform with over 100,000 customers, offering instalments across every consumer vertical and flying the flag against other sector giants such as Klarna.

- London-based private equity house BCI has now provided £15m in funding to Butter as part of a deal to support Butter’s growth.

- BCI is part of the Blenheim Chalcot Group investors in ClearScore, Agilisys and Hive Learning, founded by Sir Clive Woodward.

- Popular stores in the Butter app include Amazon, Argos, BooHoo, ASOS, H&M, Zara, Hugo Boss, Sports Direct, AirBnB, Currys PC World, Ao.com, IKEA and more.

- Download the Butter.co.uk app here

- Search Butter Holidays here

Contacts