Bitcoin Risk a myth says analyst, as data shows it can be less risk that investing in S&P and Gold

UNITED KINGDOM / AGILITYPR.NEWS / January 21, 2021 / Victor Argonov, senior analyst at International FinTech EXANTE

Since March 2017, the US Securities and Exchange Commission (SEC) has rejected applications for Bitcoin ETFs - exchange-traded funds whose prices are proportional to the value of Bitcoin (BTC). Such funds would allow market participants to invest in BTC without buying it directly. ETFs exist for many other commodities and simply quantities - ETFs for gold, ETFs for stock indices, etc. Nevertheless, it is bitcoin for the SEC that seems "unworthy", too risky a commodity.

Regularly rejecting applications for BTC-ETFs, the SEC argues this is not the problem of ETF projects, but of Bitcoin itself - an "unregulated", "volatile", "speculative", "risky" asset, "subject to manipulation." At first glance, one can’t be blamed for believing this. BTC has repeatedly deceived investors. In its history there were 2 large bubbles (2013 and 2017), when it rose in price dozens of times during that year, and then suddenly saw its price drop. There is great inequality among BTC holders. There are so-called whales, capable of large-scale buying or selling provoking excitement and seriously changing the quotes.

However, is the negativity around BTC justified? Is the BTC-ETF really risky for investors? As the statistics of recent years show, the risk of investing in BTC is actually lower than investing in the S&P index or gold.

According to our data, BTC turns out to be the least risky of the considered assets. The probability of securing a profit if invested for at least a year is higher than that for gold and the S&P. When investing for 4 years or more, this probability is even higher and sits at 100%, meaning all investors made a profit, which cannot be said about other assets. It is not hard to calculate that the long-term investment case for BTC is positive.

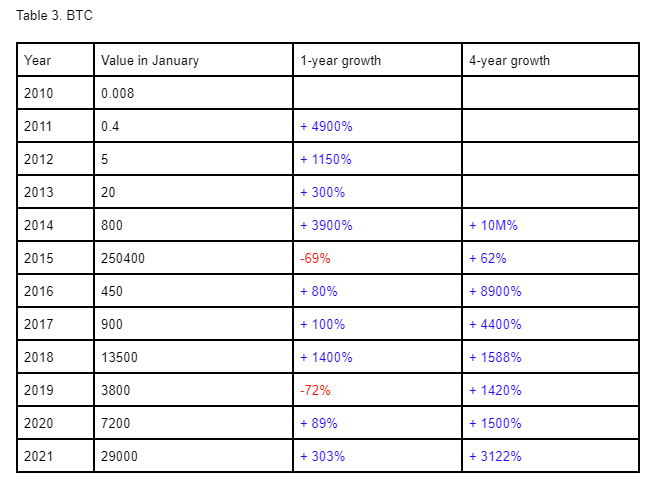

In 2020 alone, the BTC rate has risen by 303% - more than gold and the S&P in 10 years.

It is worth remembering that the SEC was created in the 1930s under the slogan "We are the investor’s advocate", then for the sake of protecting the interests of the investor. Volatility itself, the presence of a bubble, the speculativeness and even the manipulativeness of an asset is not an unambiguous evil. The key issue is the risk. The investor is afraid, first of all, of an irreparable loss of funds, which is possible when financial pyramids collapse or companies go bankrupt. The investor's goal is to generate income, and preferably more or less predictable.

How successful is BTC in this sense? How have its returns and risks in recent years fared against the S&P 500 and gold (all of which have a positive long-term trend)?

Imagine 2 types of investments: 1-year and 4-year. Most of the long-term growing assets fluctuate within one-year horizons and are not profitable in all years. So, deep drawdowns of the S&P 500 in 2000 and 2008 are well known, as well as the failures of BTC in 2014 and 2018. But if an investor has a long-term aim, they can hedge against failures by making an investment for several years at once. For example, 4, as in our example.

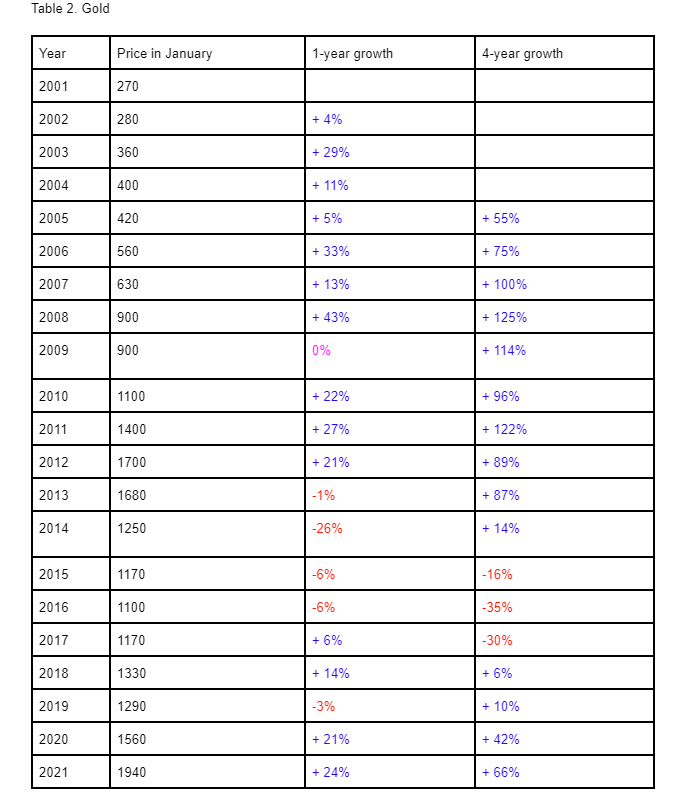

Let's calculate which of these investments were profitable or unprofitable in different years.

- If we compare the number of profitable and unfavorable years for different types of assets and investment duration we find:Among the annual investments in the S&P 500, 70% were profitable, and 30% were unprofitable. Among 4-year-olds - profitable 71%, unprofitable 29%. In most cases, profits were calculated at double-digit percentages (never exceeding 100%). The growth over the recent 10 years was + 193%.

- Among the annual investments in gold, 75% were profitable, and 25% were unprofitable. Among 4-year-olds -are profitable 82%, 18% are unprofitable. Only occasionally for a 4-year investment did the profit exceed 100%. The growth over the recent 10 years was only + 39%.

- Among the annual investments in BTC, 82% turned out to be profitable, 18% - unprofitable. Among 4-year-olds,turned out to be profitable 100%, and each of them increased capital by at least an order of magnitude. The growth over the last 10 years has been about 70 thousand times (7M%).

Perhaps the high riskiness of BTC is a myth. Until now, BTC has provided investors with more guaranteed and larger returns than such respectable destinations as gold and general market stock indices. By refusing to register BTC-ETFs, the SEC is not so much protecting investors from risk as it is preventing them from making high returns.

Contacts