Building Insulation Market Set to Bounce Back From Covid-19 by 2022

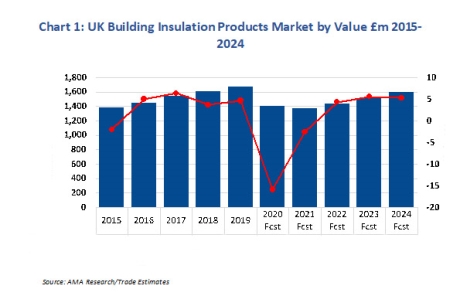

UNITED KINGDOM / AGILITYPR.NEWS / April 08, 2021 / The building market for insulation products is estimated to have fallen by around 16% to £1.4bn, mainly due to the impact of Covid-19 restrictions on newbuild and domestic retrofit activity.

Key market influences include changes to building regulations and energy prices. The Building Regulations Part L 2013 were updated with an aim of reducing carbon emissions by a further 6% on top of the 2010 standard for new domestic buildings, and by 9% for new non-residential buildings. Government subsidy schemes also drive growth in the domestic market.

Industrial energy costs have increased sharply since 2016 (although coal and gas prices fell in 2019), and in the longer-term are forecast to rise further, which is likely to result in higher end-product prices for insulation products. This is likely to be compounded by the ongoing weakness of Sterling, leading to increased import prices for many materials.

In 2015 the market for building insulation products experienced a downturn, driven by a significant fall in government-subsidies, which had previously been a large end use sector. This reduced funding to deliver the Energy Company Obligation (ECO) resulted in far lower levels of domestic installation activity compared to under previous government initiatives. Despite the decline of the retrofit market, the overall market increased year on year from 2016 to 2019 through strong demand in new housebuilding, a growing market for home extensions and a strong non-residential new build sector, particularly in 2017, which saw the total market value increase by around 6%. Growth continued in 2018 and 2019 as non-residential construction output and housebuilding levels continued to rise, despite a slowdown in some sectors, such as offices and retail, taking market value to around £1.7 billion.

Alex Blagden, Senior Market Analyst at AMA Research comments “The market is likely to decline by a further 3% in 2021, but will recover from 2022 onwards, with growth rates of around 4-6% per annum through to 2024”.

This recovery is likely to be driven by strong demand for new housing, recovering levels of non-residential new work and the prospect of an improved retrofitting market through increased ECO funding from 2022.

Note:

The information was taken from the Building Insulation Products Market Report – UK 2021-2025 by AMA Research, which is available to purchase now at www.amaresearch.co.uk or by calling 01242 235724.

About Us

AMA Research is a leading provider of market research and consultancy services with over 30 years’ experience within the construction and home improvement markets. For more information, go to www.amaresearch.co.uk or follow us on Twitter @AMAResearch for all the latest building and construction market news.

Since 2017, AMA Research has been part of Barbour ABI, a leading provider of construction intelligence services. Barbour ABI is part of UBM, which in June 2018 combined with Informa PLC to become a leading B2B information services group and the largest B2B Events organiser in the world. To learn more and for the latest news and information, visit www.ubm.com and www.informa.com.

Contacts