Conflict of Interest in Investment Advice Within Retirement Plans & Policy to Protect Investors/Prevent Eroding Retirement Savings

ORLANDO, FLORIDA / AGILITYPR.NEWS / September 18, 2023 / Conflict of Interest in Investment Advice Within Retirement Plans & Policy to Protect Investors/Prevent Eroding Retirement Savings

Call to Action: There is a conflict of interest in investment advice within retirement plans that requires public policy decisions by various administrations to require policies and procedures to ensure that any advisers who accept conflicted payments are properly incentivized to serve clients’ interests and erodes retirement savings.

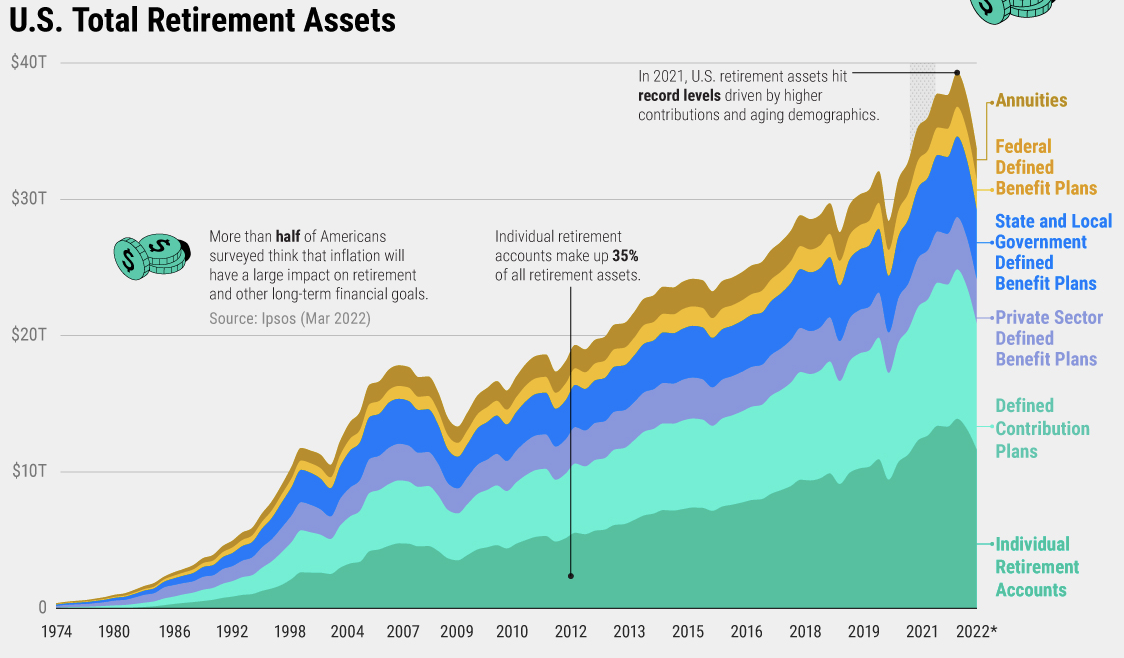

Stat/ Fact Needed for Action: Conflicted advice leads to lower investment returns to investors. Meaning - savers receiving conflicted advice earn returns roughly 1 percentage point lower each year (for example, conflicted advice reduces what would be a 6 percent return to a 5 percent return). An estimated $1.7 trillion of IRA assets are invested in products that generally provide payments that generate conflicts of interest. Thus, we estimate the aggregate annual cost of conflicted advice is about $17 billion each year. Collectively, more than 40 million American families have savings of more than $7 trillion in IRAs. More than 75 million families have an employer-based retirement plan, own an IRA, or both. Rollovers to IRAs exceeded $300 billion in 2012 and are expected.

Analogy Why Change Is Needed: “Fox guarding the henhouse meaning -- conflicted advice leads to large and economically meaningful costs for Americans’ retirement savings.

OVERVIEW:

Here's an overview related to this important public policy consideration:

Introduction:

- Pensions are voluntary benefits offered by employers to assist employees in preparing for retirement.

- Pension plans can be classified based on several dimensions, including Defined Benefits (DB) vs. Defined Contributions (DC) plans, private vs. public sector sponsors, and single vs. multiple employer plans.

- Federal pension laws and regulations, particularly those from the Department of Labor (DOL), play a crucial role in governing pension plans and investment advice.

Recommendations Within Pension Plans:

- Retirement plans are complex, and individuals often rely on financial-services professionals for assistance in decision-making.

- Conflict of interest can arise due to compensation structures that incentivize certain recommendations.

- Standards of conduct for individuals providing recommendations within pension plans vary depending on their roles and actions.

Federal Pensions Law (ERISA):

- The Employee Retirement Income Security Act of 1974 (ERISA) is a federal law that sets fiduciary standards for individuals responsible for making decisions within private sector pension plans.

- ERISA also prohibits certain transactions that could harm pension plans.

Prohibited Transaction Exemptions (PTEs):

- Prohibited Transaction Exemptions (PTEs) are exceptions that allow certain transactions between pension plans and service providers that would otherwise be prohibited under ERISA.

Current Investment Advice Regulations:

- DOL issued regulations in 1975 that established a five-part test to determine if an individual providing investment advice is subject to the fiduciary standard.

- This test involves criteria such as the regularity of advice, mutual understanding, and individualization of advice.

- Some financial professionals, like broker-dealers, may be subject to other regulatory structures, such as the Securities and Exchange Commission's (SEC) Regulation Best Interest (Reg BI).

Recent Regulatory Actions:

- The document discusses regulatory actions taken in response to evolving retirement landscapes. These include the expansion of the definition of fiduciary advice in 2016 and subsequent legal challenges.

- It also mentions the issuance of PTEs, including the Best Interest Contract Exemption and Principal Transactions Exemption.

Actions Under the Trump Administration:

- During the Trump administration, there were changes to enforcement policies and legal challenges, leading to the reinstatement of the five-part test.

Actions Under the Biden Administration:

- The Biden administration signaled its intent to redefine when a person providing investment advice should be considered a fiduciary.

- A proposed rule submitted to the Office of Management and Budget (OMB) in September 2023 aims to update the definition of investment advice.

Responses to Notice of Proposed Rule in the 118th Congress:

- Senator Bill Cassidy and Representative Virginia Foxx expressed opposition to the proposed rule, citing concerns about market confusion and compliance expenses resulting from shifting interpretations of fiduciary standards.

In summary, this article provides a quick overview of the regulatory history, challenges, and recent developments related to conflict of interest in investment advice within retirement plans, highlighting the role of federal laws and the evolving landscape of retirement planning in the United States.

Here are some key points and takeaways from this article:

- Types of Retirement Plans: The document starts by mentioning that retirement plans can be defined benefit (DB) plans or defined contribution (DC) plans, and they can be sponsored by private or public sector employers. It also distinguishes between plans sponsored by a single employer and those sponsored by multiple employers.

- Regulation of Investment Advice: The Department of Labor (DOL) plays a significant role in regulating investment advice within retirement plans. The DOL issued regulations in 1975 that defined investment advice using a five-part test. In 2016, DOL expanded the definition of investment advice, but this expansion was vacated by a U.S. court of appeals in 2018.

- Proposed Rule in 2023: In September 2023, DOL submitted a proposed rule for review to the Office of Management and Budget (OMB) aimed at more appropriately defining when recommendations constitute investment advice.

- Conflicts of Interest: The document highlights that conflicts of interest can arise in investment advice within retirement plans, especially when financial professionals' compensation is tied to the recommendations they make. Such conflicts could potentially lead to recommendations that are not in the best interest of clients.

- Federal Pensions Law (ERISA): The Employee Retirement Income Security Act of 1974 (ERISA) establishes fiduciary standards for individuals responsible for making decisions within private sector pension plans. ERISA also prohibits certain transactions that may harm pension plans.

- Prohibited Transaction Exemptions (PTEs): To facilitate transactions between pension plans and service providers that would otherwise be prohibited by ERISA, various Prohibited Transaction Exemptions (PTEs) exist.

- Current Investment Advice Regulations: The document explains the five-part test established by DOL in 1975 to determine whether an individual providing investment advice is subject to the fiduciary standard. It also mentions other regulatory structures, such as the Securities and Exchange Commission's (SEC) Regulation Best Interest (Reg BI).

- Recent Regulatory Actions: The document discusses regulatory actions taken during different administrations, including the 2016 rule expansion, temporary enforcement policies, and the reinstatement of the five-part test in 2018. It also mentions PTE 2020-02 and subsequent legal challenges related to rollover recommendations.

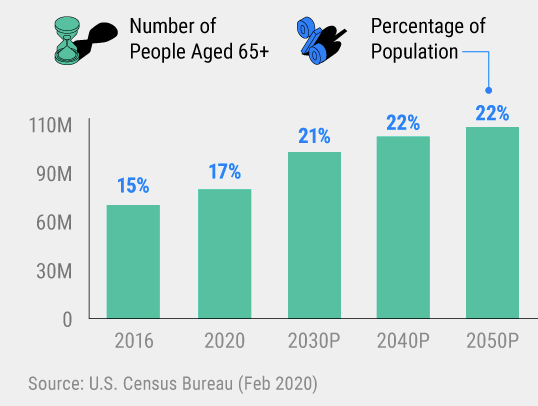

- Actions Under the Biden Administration: Under the Biden administration, DOL has proposed a new rule to redefine when a person providing investment advice would be considered a fiduciary. The changing retirement landscape and the prevalence of DC plans are cited as reasons for this proposed rule.

- Responses to Proposed Rule: Some members of Congress, such as Senator Bill Cassidy and Representative Virginia Foxx, have expressed opposition to a rule that revises the definition of fiduciary under ERISA, citing concerns about market confusion and compliance expenses.

CONCLUSION:

The challenge of addressing the cost of conflicted investment advice and its effects on Americans’ retirement savings, with a focus on IRAs suggests that conflicted advice reduces investment returns by roughly 1 percentage point for savers receiving that advice. In the aggregate, such savers hold about $1.7 trillion of IRA assets. Thus the aggregate annual cost of conflicted advice is about $17 billion each year. The conclusion of this article should not mask the essential finding that conflicted advice leads to large and economically meaningful costs for Americans’ retirement savings. Even a far more conservative estimate of the investment losses due to conflicted advice, such as half of a percentage point, would yield annual losses of more than $8 billion. Therefore, if conflicted advice affects a larger portion of IRA assets than the $1.7 trillion considered here—or if the estimate were extended to other forms of retirement savings—the total annual cost would exceed $17 billion.

ABOUT COLCOMGROUP

https://www.linkedin.com/in/davidcolgren/

Accomplished business development, government affairs, media relations, strategic relations, marketing, branding and communications executive with experience in accounting, legal, consumer goods, financial services, technology and professional services sectors.

Counsel clients in variety of areas: global private placement advisory services, capital fundraising, debt/equity financing, sponsorship, CSR/ESG advisory services, LGBTQ diversity, equity and inclusion, strategic planning, new product development, product launches, direct marketing, collateral and advertising design, copy writing/writing, speech writing, business plan/marketing plan/communications plan development, product/service positioning and branding, media relations, government affairs, media training, message point development, image management, new business development, and strategic partner development/third party outreach. Cancer survivor and advocate.

We speak regularly to professionals on marketing and communications topics. Specialties include:

- Media Relations

- Marketing

- Branding

- Positioning

- Business Development

- Government Affairs

- Message Development

- Image Management

- Issues Management

- Strategic Planning

- Product Development

- Product Launches

- Strategic Partner Development

- Human Capital / Diversity, Equity and Inclusion

- LGBTQ Diversity, Equity and Inclusion

- Cybersecurity

- Cryptocurrency

- Forensic Accounting

- White Collar Crime Issue

- Sponsorship Sales

- Membership Marketing

- Human Capital Disclosures

- Financial & Non-Financial Reporting Standards

- ESG Corporate Disclosures - Climate / Human Capital

- CPE Marketing

- Personal Finance/ Wealth Management

- Big Data/ Data Analytics

- iXBRL

- Crowd Funding/Sourcing

Social Media:

#bearmarket #bullmarket #bitcoin #cryptocurrency #financialfreedom #mining #algorithm #goinglong #endthefed #earlyadopter #reality #itwasalladream #manifest #proofofstake #proofofwork #coinbase #blockchainrevolution #blockchain #gdax #bitconnect #bittrex #plutocracy #oligarchy #trueworldorder #tyranny #transparency #accountability #pcaob #workfromhome #bitcoiner #highfrequency #stockmarket #controls #stockmarketinvesting #nifty #stocks #intradaytrading #valueinvestor #daytrading #investingforbeginners #longterminvesting #dividendstocks #nyse #dividendinvesting #stockmarketcrash #pennystock #governance #iia #nasdaq #personalfinance #wealthmanagement #whistleblower #retirement #savings #definedcontributions #internalauditor #definedbenefits #bengraham #fundamentalinvesting #investorprotection #internalcontrols #investinginmyself #financialadvisor #internalcontrols #dividendincome #internalauditor #cfo #generalcounsel #benjamingraham #investmentrealestate #warrenbuffetquotes #investing #charliemunger #stockpicks #buylowsellhigh #buylow #trader #fundamentalanalysis #fiduciary #conflictsofinterest #governance #money #accountant #auditor #shadowbanking #stockexchanges #banks #finance #cpa #pfs #money #banking #cryptocurrency #iia #bitcoin #ima_news #bank #business #blockchain #realestate # #worldstockexchanges #nasdaq #cash #cfo #investor #financialfreedom #bosstime #fintech #cfo #theboss #creditunions #art #economy #forex #investor #investment #florence #trading #usa #payments #btc #stockmarket #bankers #stocks #loans #investing #payment #corpgov #pcaob #markets #technology #atm #news #creditrepair #love #bankstatement #cpa #financialservices #abaesq #ifc #loan #credit #ecommerce #atms #climatefinance #investor #bsa #bankonit #business #smallbusiness #money #coo #news #fintech #regtech #fhlb #pfs #cfpb #technology #investment #depositinsurance #cpa #peace #financialservices #fintech #financialplanning #bitcoin #sec_news #financialfreedom #credentials #personalfinance #nakingtrading #sec_news #iosco

About Us

ABOUT COLCOMGROUP

https://www.linkedin.com/in/davidcolgren/

Accomplished business development, government affairs, media relations, strategic relations, marketing, branding and communications executive with experience in accounting, legal, consumer goods, financial services, technology and professional services sectors.

Counsel clients in variety of areas: global private placement advisory services, capital fundraising, debt/equity financing, sponsorship, CSR/ESG advisory services, LGBTQ diversity, equity and inclusion, strategic planning, new product development, product launches, direct marketing, collateral and advertising design, copy writing/writing, speech writing, business plan/marketing plan/communications plan development, product/service positioning and branding, media relations, government affairs, media training, message point development, image management, new business development, and strategic partner development/third party outreach. Cancer survivor and advocate.

We speak regularly to professionals on marketing and communications topics. Specialties include:

- Media Relations

- Marketing

- Branding

- Positioning

- Business Development

- Government Affairs

- Message Development

- Image Management

- Issues Management

- Strategic Planning

- Product Development

- Product Launches

- Strategic Partner Development

- Human Capital / Diversity, Equity and Inclusion

- LGBTQ Diversity, Equity and Inclusion

- Cybersecurity

- Cryptocurrency

- Forensic Accounting

- White Collar Crime Issue

- Sponsorship Sales

- Membership Marketing

- Human Capital Disclosures

- Financial & Non-Financial Reporting Standards

- ESG Corporate Disclosures - Climate / Human Capital

- CPE Marketing

- Personal Finance/ Wealth Management

- Big Data/ Data Analytics

- iXBRL

- Crowd Funding/Sourcing

Contacts

David Colgren

CEO-COLCOMGROUP

dcolgren@colcomgroup.comPhone: 917-587-3708

https://www.linkedin.com/in/davidcolgren/