GLOBAL WARMING CRISIS REQUIRES IMMEDIATE SOLUTION TO BETTER CONNECT +1/3 OF THE WORLD'S CAPITAL MARKETS NOW FOCUSED ON SUSTAINABILITY INVESTMENTS

ORLANDO, FLORIDA / AGILITYPR.NEWS / March 02, 2023 / WHY ARE WE NOT MOVING FAST ENOUGH IN THE UNITED STATES TO SUPPORT THE CAPITAL MARKETS AND TACKLE THE MOST EFFECTIVE WAY TO MITIGATE GLOBAL WARMING? WILL THE UNITED STATES JOIN INTERNATIONAL EFFORTS? WHERE DO WE STAND?

- CALL TO ACTION: Securities regulators (US SEC) and others today must mandate a national climate change disclosure rule to tackle global warming/ climate change through better transparency/accountability/ comparability worldwide.

- STAT - Global insured losses from natural disasters in first half 2023 pegged at $53B - but almost all (95%) of the S&P 500 already voluntarily report climate finance metrics to global investors annually. Unlike financial statement disclosures for transparency and accountability (backed by internal and external audit assurances) – climate finance is only “voluntary” at the table in the United States. A new government mandate can help better connect investors to the +$30 trillion sustainability investment assets under management marketplace (impact investing through common, comparable, machine-readable metrics for climate finance change ASP.

- ANALOGY - Without a US SEC climate change mandate -- then If you invest in a company without a government mandate for climate finance investing than "I have a bridge in Brooklyn to sell to you.” or better yet - "it's call Greenwashing Fred without a government mandate that links into a global framework meaning better comparison, access to the global capital markets and reduced regulatory regime if global... ONE REPORT - ONE GLOBAL AUDIENCE..."

BACKGROUND

BREAKING NEWS - Update - the US SEC Will Vote On Climate Rule In October, With Potential To Implement From January 2024. Stay tuned for October, 2023!

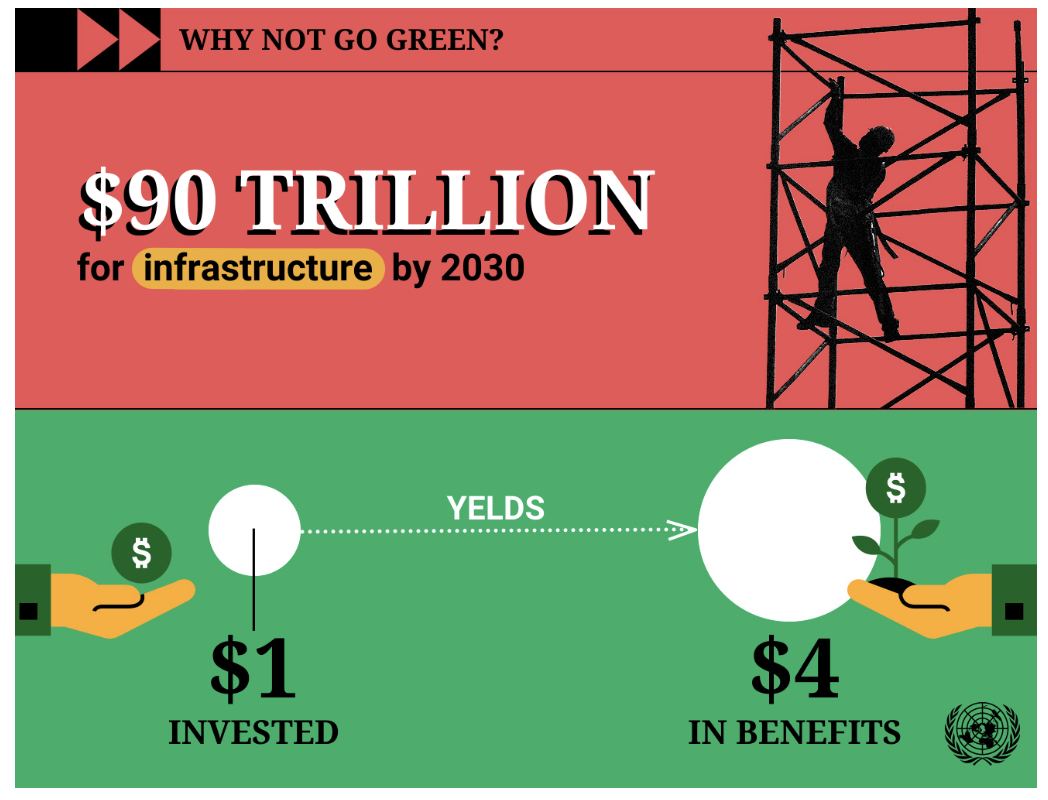

Question: If we the People of United States) believe in capital markets, transparency and accountability to better connect investor to "supply and demand" needs - why not climate finance NOW– for decision making using data like financial statements? Why is this such an issue for industry, securities regulators and stakeholders finalizing standard metrics linked to a thriving growing -- $30 trillion global #sustainability investment marketplace? This is a NO-BRAINER! Again – "supply and demand" supporting a global regulatory infrastructure to create new innovation, for better jobs and new clean energy? What’s holding things up -- and what can we learn now about cryptocurrency fraud that can be updated in a US Securities & Exchange Commission's proposed climate finance rule to include better governance to protect the investor? What can securities regulators mandate Climate Finance Disclosure and embrace a One Global Reporting Framework for disclosure now?

What we know (Thank you Brad Monterio):

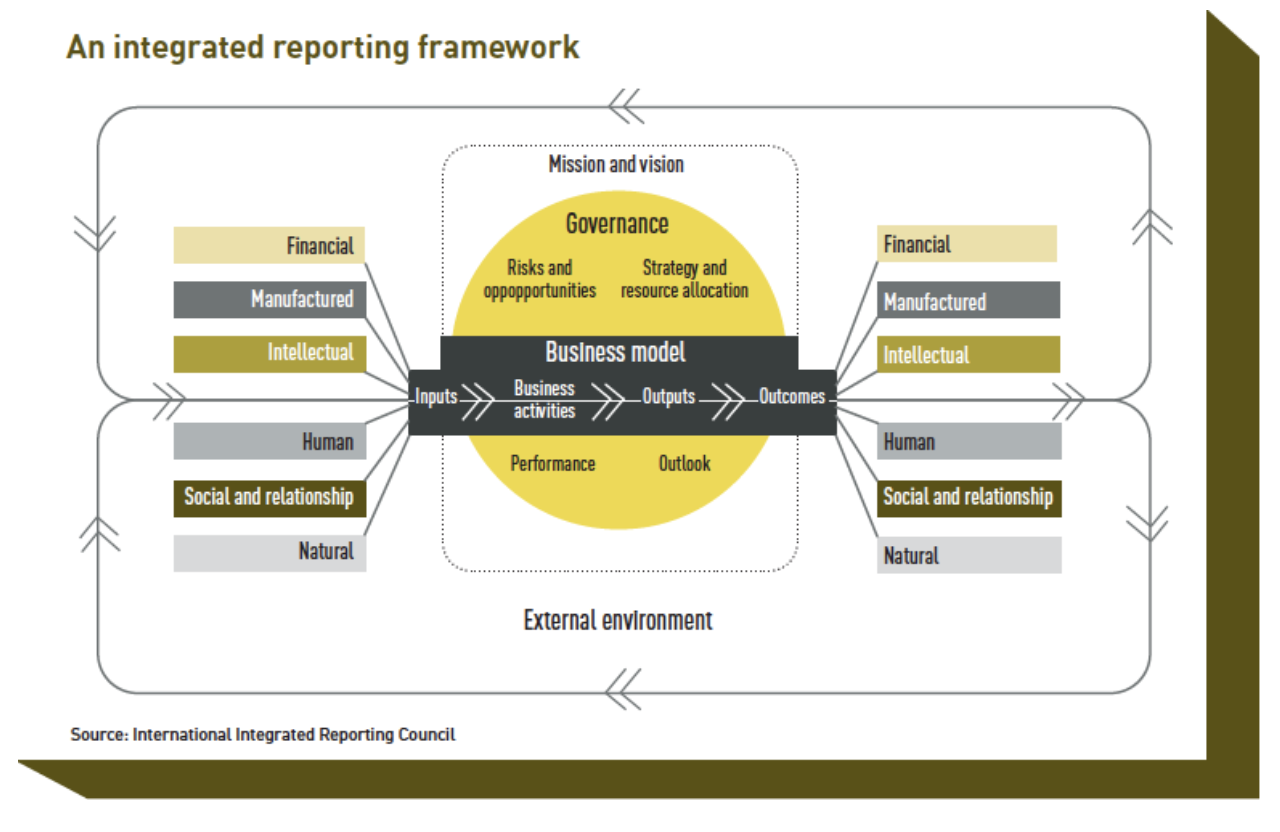

Corporate disclosure/ investor product is the umbrella term for all the stocks, bonds, options, derivatives and other financial instruments that people put money into in hopes of earning profits needs to move beyond traditional financials over many decades to better meet the needs of investors, analysts, regulators and other stakeholders.

Consider the recent growth in non-financial disclosures about material, decision-useful environmental, social and governance (ESG) factors; as well as the rise in corporate social responsibility (CSR), sustainability and integrated reports.

Stakeholders—those with a vested interested in the actions, performance results and impacts of companies—want more three-dimensional information that indicates a company’s overall contribution to society’s sustainability. This is causing corporates to move beyond simply reporting on financial performance to include information about environmental impact and use of natural resources, labor practices, compensation models, community engagement, social programs, business models, strategy, plans for future growth and economic value, and so much more.

In short, this enhanced information set is intended to help stakeholders more accurately determine whether a business should have a “license to operate” and is sustainable for the long term.

Millions of small private businesses that are supply chain partners with publicly traded companies are increasingly being required to disclose sustainability information to government agencies and public companies (e.g., disclosures about conflict minerals, human trafficking, child labor). This is not merely a “big company” or public company issue.

A Paradigm Flip: Value Outside the Financials This quest for sustainability information is supported by Ocean Tomo’s 2010 study, Intangible Asset Market Value, which found that more than 80 percent of a company’s value today is seen outside of the financial reports in these other areas. This is a paradigm shift from just three decades earlier, indicating a comparatively rapid change within the much longer, 100-year history of financial reporting. The move toward non-financial disclosures is occurring on a global scale, with capital markets worldwide seeing similar, increased demand from stakeholders for material disclosures that include extra-financial information.

The growth in non-financial, sustainability disclosures benefits stakeholders by giving them a more comprehensive set of inputs to make decisions. However, this burgeoning area also introduces challenges, particularly for regulatory bodies charged with protecting the public interest. In the United States, the SEC serves this role, ensuring that the investing public has real-time access to reliable and relevant material information for investment decisions.

SEC Oversees Material Disclosure, Both Financial and Non-financial As described on the SEC website, “The mission of the SEC is to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation … The laws and rules that govern the securities industry in the United States derive from a simple and straightforward concept: all investors, whether large institutions or private individuals, should have access to certain basic facts about an investment prior to buying it, and so long as they hold it.”

To achieve its mission, the SEC requires public companies to disclose material information to the public. Although it does not mandate or require disclosure of any specific non-financial metrics in 10-K and related regulatory compliance filings, it does require material disclosures that can include information about ESG or non-financial factors.

In other words, companies must disclose information of a material nature, whether financial or not. Is this a de facto “requirement” to disclose non-financial, material data to the public in the absence of an SEC regulatory mandate? If it quacks like a duck …

An Additional Challenge: Equilibrium Given the relative newness of material, non-financial information in corporate sustainability disclosures, there is inequality between the level of market trust in disclosed, independently verified financial data and that of a non-financial nature. External financial compliance reporting is a mature practice among U.S. corporations trusted by investors, analysts, regulators and other stakeholders. This process includes:

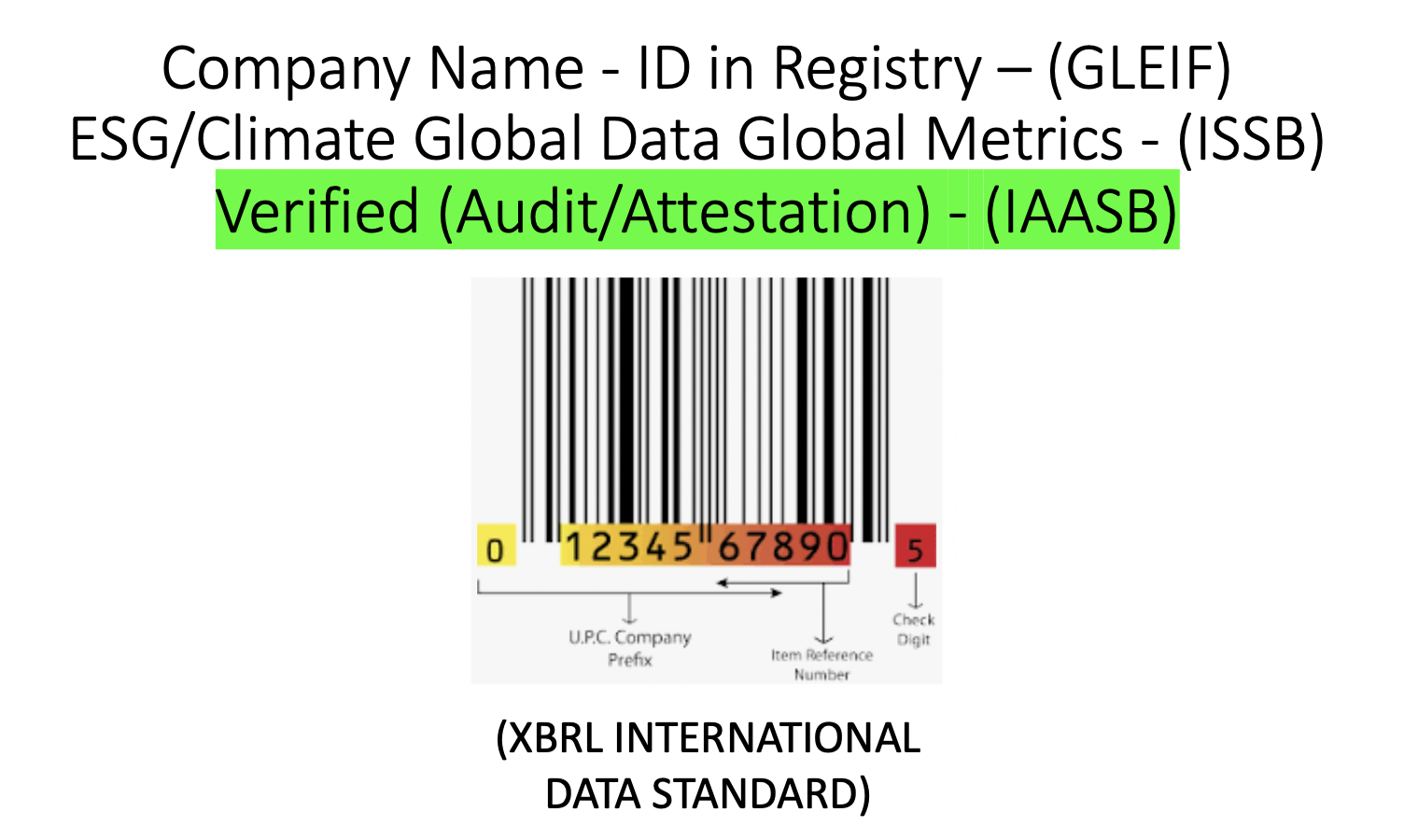

• SEC-mandated financial disclosures flow through the information supply chain to investors, analysts and stakeholders under a well-established EDGAR filing process.

• U.S. accounting standards, set by the Financial Accounting Standards Board, used by public companies to disclose financial information to the investing public, ensure consistency and comparability of financial disclosures.

• Public accounting firms provide independent assurance of financial disclosures to gain trust and reliability in the disclosed information.

Contrast this trusted financial disclosure process with that of non-financial sustainability information and the inequalities become apparent:

• Although material, non-financial information can be disclosed through SEC filings, it is not clear where and how this should/could be reported in the filings.

• FASB does not set accounting standards regarding non-financial, sustainability topics, calling into question the ability of investors and other stakeholders to understand how sustainability information is derived or calculated, not to mention the distrust and lack of consistency and comparability resulting from the absence of a uniform accounting standard for reporting on sustainability topics.

Independent assurance around sustainability disclosures also is an emerging area, with Big Four firms providing opinions on sustainability reports in some markets around the world. However, this is not widely practiced, and there is not a uniform standard for assurance of this information. As with the lack of accounting standards for sustainability topics, this breeds distrust—or at least skepticism—of sustainability disclosures.

Non-financial sustainability disclosures are an emerging area about which companies, supply chains and external stakeholders are still learning. These disclosures need to come into equilibrium with financial disclosures to enjoy the same level of trust and reliability for investment decision-making and performance comparisons. Today, there is an organization to help do just that.

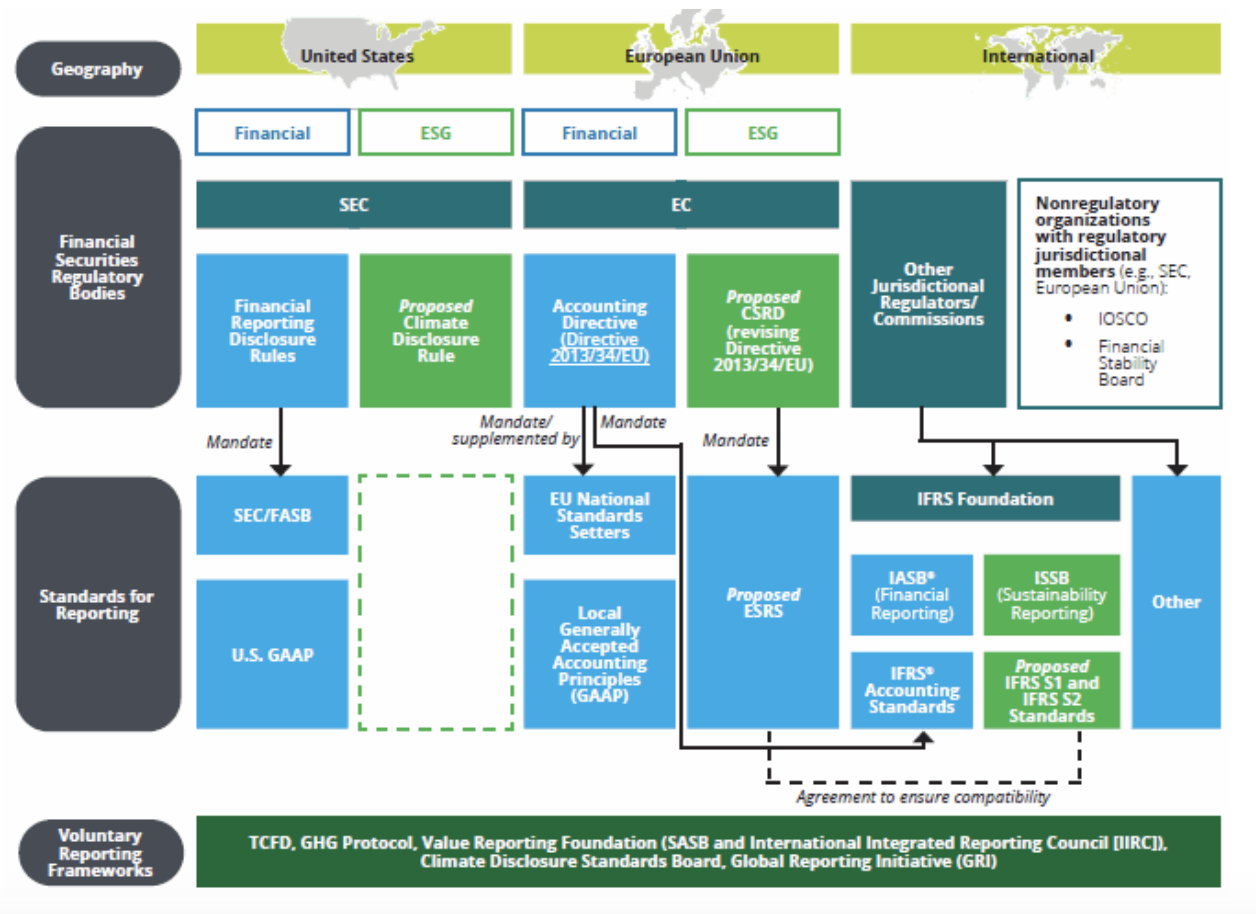

SO WHERE WE ARE WITH CLIMATE FINANCE INTERNATIONALLY:

Regardless of the United States – EU and other Capital Markets have moved forward in adopting ONE GLOBAL CLIMATE DISCLOSURE STANDARD that will be finalized by the middle of this month (June 2023) to tap into the $30 trillion sustainability marketplace.

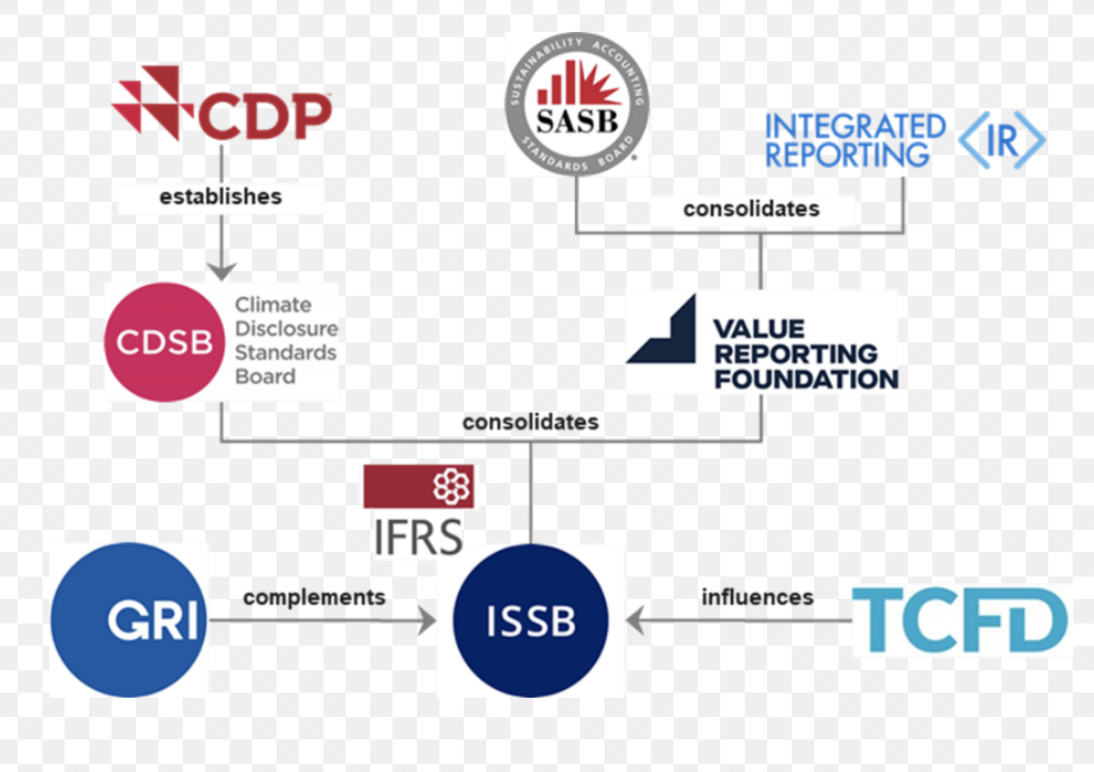

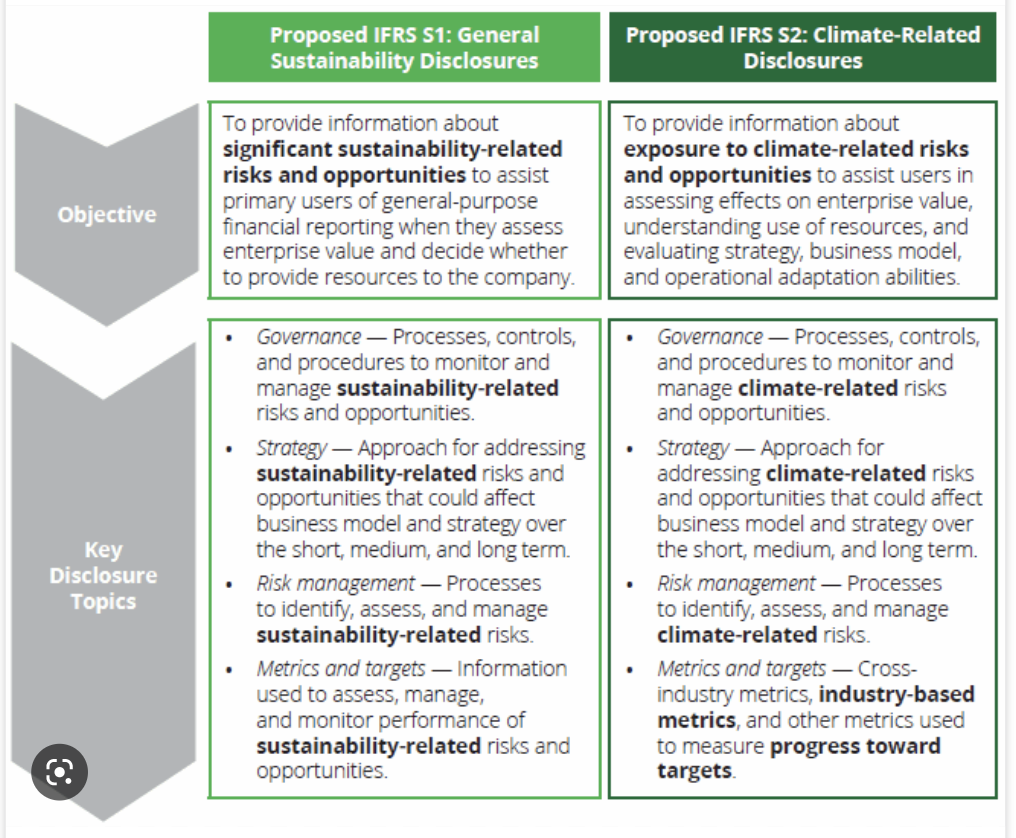

In late February 2023, the International Accounting Standards Board (IASB) confirmed that the International Sustainability Standards Board (ISSB) will it issue its final technical content of its first two exposure drafts sustainability disclosure standards (See Deloitte Chart on both elements of proposed standards). The ISSB is supported by the G7, the G20, IOSCO, the Financial Stability Board, African Finance Ministers and Finance Ministers and Central Bank Governors from over 40 jurisdictions. The IFRS’s members are many of the 150 countries that are part of this accounting standard.

First Two Global Corporate Disclosure Sustainability Standards:

- Exposure Draft IFRS S1 – “Overall requirements with the objective of disclosing sustainability-related financial information that is useful to the primary users (See target list of stakeholders) of the entity’s general purpose financial reporting when they assess the entity’s enterprise value and decide whether to provide resources to it.”

- Exposure Draft IFRS S2 – “The objective of the Exposure Draft is to require an entity to provide information about its exposure to climate-related risks and opportunities. This information, along with other information provided as part of an entity's general purpose financial reporting, will assist users of the information in assessing the entity’s future cash flows, including their amounts, timing and certainty, over the short, medium and long term. This information, together with the value attributed by users to those cash flows, enables their assessment of the entity's enterprise value.”

The ISSB statement last month indicated that the expected issuance of both standards will be finalized by the Q2 2023 (Possibly June 2023).

According to the ISSB’s statement, its members unanimously approved entering the thorough drafting and formal balloting process (standard review before formal publication), ahead of expected issuance of the standards at the end of Q2 2023 and would be effective starting January 2024. This would require reporting in 2025 on a company’s information collected in 2024.

PAGE 2 (Continued)

Each country could differ country to country BUT companies can globby disclose international comprehensive, transparent, comparable, machine-readable sustainability-related metrics to bolster the capital markets through better accountability, assurance and attestation throughout the supply chain of stakeholders. The ISSB global disclosure standard that investors can use will help create a “brightline” both smaller and large companies using the framework.

Again, the opportunity to connect investor access to climate finance supported by both assurance INSIDE and OUTSIDE auditors will provide better "TRUST" which has not been down before ON A GLOBAL BASIS (Like taking “SOX 404 Internal Controls” in the US for financial reporting and moving this same governance framework GLOBALLY) to protect INVESTORS using both new IFRS S1, S2 GLOBAL governance framework.

Not one auditor -- but BOTH internal auditors (Their Governance Standards) and independent external auditors (Their Governance Standards) to review climate financial data for BETTER GOVERNANCE to prevent "Greenwashing" and “DOUBLE” PROTECT "Investor Protection" "risk"...

This regulatory framework for climate finance is missing in the proposed ISSB disclosure rule -- playing around with a $30 trillion sustainability investing marketplace right out of the box for failure -- LIKE ENRON, Madoff or $80 Billion cryptocurrency fraud crisis today INFRASTRUCTURE GOVERNANCE is needed NOW before issuing a final ISSB climate disclosure rule. Why not choose for the gold standard of governance offering the best customer with the best possible product? Why settle for less regarding climate finance investor participation. Doomed before we start -- without critical governance pillars to support the Capital Markets. Do we risk investor pension plans into climate finance without this governance/ "greenwashing"...?

The intention is for the ISSB to deliver a comprehensive global baseline of sustainability-related disclosure standards that provide investors and other capital market participants with information about companies’ sustainability-related risks and opportunities to help them make informed decisions. PERIOD.

The ISSB standards are critical in establishing a dual “financial reporting” infrastructure building upon decades of governance (+100 plus years to perfect financial statement stakeholder engagement ) and use the same level of transparency and accountability to better tackle climate finance and also leverage new opportunities and create new solutions to directly challenge CLIMATE CHANGE head-on.

KEY ADVANTAGE -- What is clear is creating ONE GLOBAL climate finance disclosure framework (Instead of individual country specific frameworks) allow for ONE INFRASTRUCTURE GOVERNANCE FRAMEWORK that can be replicated -- cost effective - using one technology framework to mitigate regulatory compliance costs to companies to “super-charge” CAPITAL MARKET efficiencies for ALL THE WORLD to tackle CLIMATE CHANGE NOW. This includes using one data format to machine-readable to "super-charge" data analytics, comparison, best-in-practice operations to harmonize and tweak better capital market efficiencies -- Thinking SPACE-X rocket model?

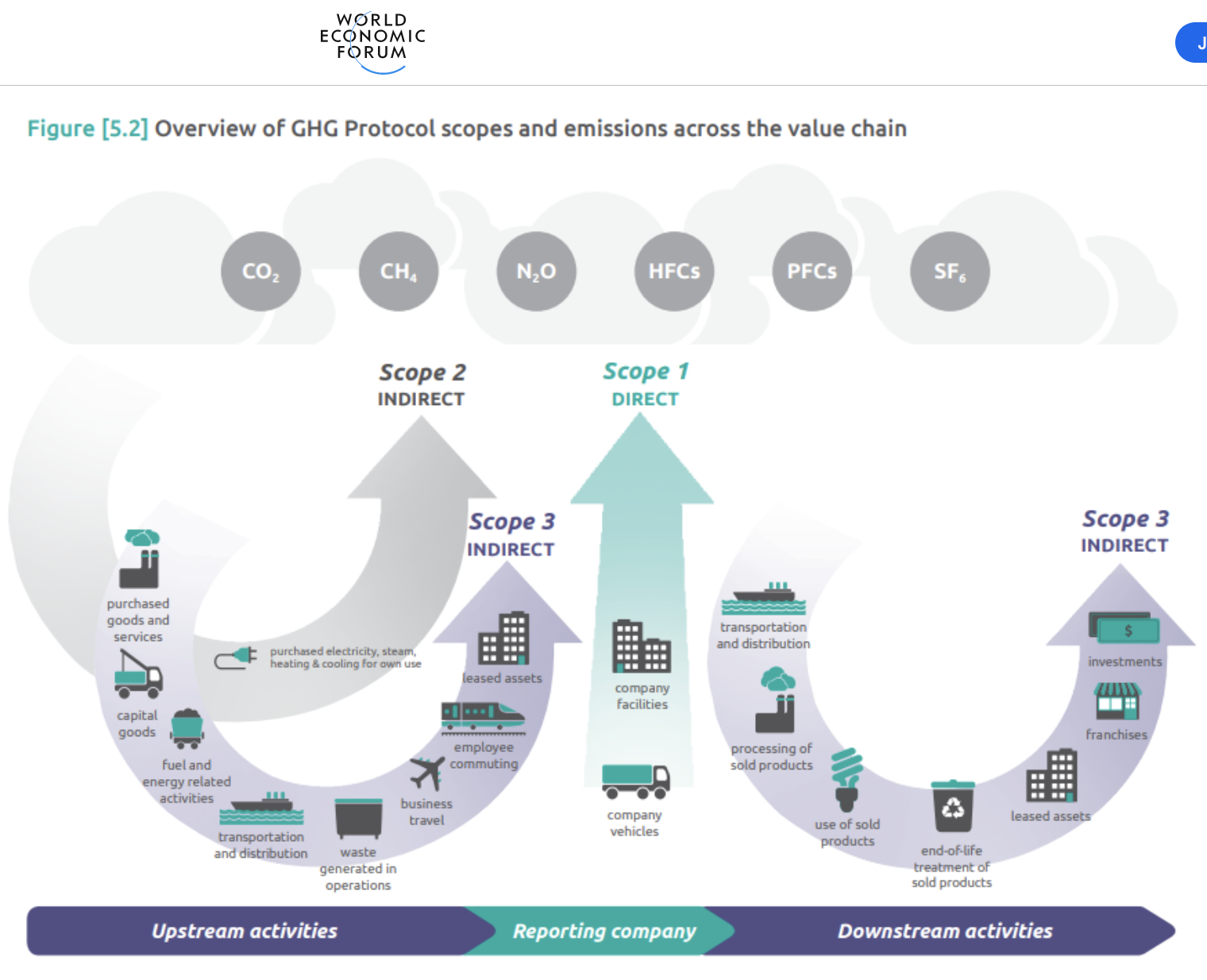

Key Debate Item in the United States Dealing with SCOPE 3 and Why?

What will the United States do related to “Scope 3 Emission”? The ISSB standards are being backed by G7 and G20 and the other regulatory authorities listed above. Under Scope 3 it also encompasses emissions that are not produced by the company itself, and not the result of activities from assets owned or controlled by them, but by those that it's indirectly responsible for, up and down its value chain. An example of this is when we buy, use and dispose of products from suppliers that must be calculated. As expected, the final version of ISSB’s initial standards include disclosure of Scope 3 emissions, when material, in addition to Scope 1 (direct emissions from a company) and Scope 2 (indirect emissions from electricity purchased and used). Disclosures on material categories of Scope 3 emissions will be calculated for a total GHG Protocol Corporate Standard. Will the US join or fall behind UK, EU and other Asian countries? Will multi-national companies based in the United States move to ISSB standards regardless of US SEC regulations?

Can New Global IFRS S1 and S2 Better Connect and Support Africa and Asian - Growing Sustainability Investing Marketplace?

This includes connecting better to ASIA > by far the largest continent in the world having 4.6 billion of the world's 7.7 billion-person population as well as AFRICA > the fastest growing population in the world and home to the longest river in the world, the Nile. It stretches 4,100 miles the from Sudan to the Mediterranean Sea.

Today there are close to 45,000 listed countries in the world, the largest in the United States and connecting to the largest economies of the world using ONE GLOBAL STANDARD WITH GLOBAL GOVERNANCE for climate finance to make and provide better reports backed by data for better decision making makes a faster, cheaper better way to tackling climate change.

More Information/ Stay Tuned:

We’re not too late! To learn MORE >> visit ISSB’s latest information as more and more securities regulators (like the USA) and exchanges come on board to support better climate finance and make a difference.

#issb #ifrs #oecd #unsdg #fsb #climatechange #tcfd #environment #sustainability #nature #globalwarming #climate #climatecrisis #ecofriendly #iaasb #climateaction #zerowaste

#ecofriendly #sustainableliving #environment #zerowaste #sustainablefashion #nature # #plasticfree #eco #reuse #design #green #organic #fashion #handmade #vegan #architecture #innovation #slowfashion #renewableenergy #climateaction #recycling #circulareconomy #esa #sfdr #ghgemissions #love #sustainable #earth #gogreen #plasticfree #gensler #mountains #sustainableliving #climateemergency #controls #recycle #pollution #iss #esg #conservation #climatejustice #federalreserve #occ #fdic #cdp #treasury #usdol #wildfires #climatestrike #covid #ima_news #parks #renewableenergy #sdgs #water #greenwashing #internalcontrols #photography #savetheearth #reuse #conservation #ocean #internalaudit #art #pcaob #love #esef #platsics #disclosure #noplanetb #plasticpollution #biodiversity #wildlife #energy #cop #ecology #treasury #nyse #instragood #noplastic #saveourplanet #earthday #cleanenergy #cop22 #bethechange #usgaap #impactinvesting #ceres #usdoi #parisaccord #environmentallyfriendly #whitecollarcrime #greenenergy #nasdaq #science #sec_news #sasb #bloomberglaw #saveearth #morningstar #naturephotography #iasb #esma #future #repost #sri #renewables #morningstar #bloomberg #environmentalist #ifac #climatechange #regulations #accounting #conservation #fedcfo #omb #climatechangesolutions #cia #carbon #standards #climatechangeprotest #forensicaccountant #unglobalcontact #thomsonreuters #environment #climatechangematters #climatechangenow #climatechanged #climatechangedeniers #potus #farms #epa #usdoe #nationalparks #climatechangeimpact #climatechangeadaptation #climatechangeconference #usgovernment #usa #covid #government #iosco #uspolitics #risingwater #america #esg #unitedstates #washingtondc #politics #washington #ushistory #news #us #freedom #americanhistory #usproblems #uspresident #whitehouse #americangovernment #ice #systemicrisk #truth #pol #reuters #unitednations #american #blacklivesmatter #ww #usgovt #usg #president #usarmy #nyc #usconstitution #iia #afghanistan #blm #dc #republican #pandemic #ussenate #uscongress #ussupremecourt #democrat #taxation #federalgovernment #knowledgeispower #usa #truth #freedom #america #news #coronavirus #staystrong #law #abaesq #accounting #audit #knowledgeispower #welding #usdol #fiduciary #kodiakhub #diligent #s&pglobal #ulsolutions #navex #onetrust #workiva #sustainIQ #mscIInc #sustainalytics @SEC_News @ESMA @IOSCO

About Us

David Colgren is Chief Executive Officer of Colcomgroup, Inc., a global consulting, marketing and business communications services firm based in New York City and Orlando. He advises companies on growing market share, opening new markets, developing new revenue streams, driving market adoption, and sourcing strategic partners. David consults clients in the capital markets/financial services, financial technology, XBRL, ESG, forensic accounting, integrated reporting, sustainability, CSR, accountancy, diversity, equity and inclusion, financial technology, regulatory oversight, academic advocacy, business valuation and investment advisory sectors. He advises corporations, professional associations, standard setters, accountancy bodies, technology vendors, consulting firms and others for more than 35 years.

Contacts