How Do Your Savings Compare to the Rest of the UK?

UNITED KINGDOM / AGILITYPR.NEWS / April 16, 2020 / A Third of Brits Have Less Than £1,000 in Savings

In this time of panic and uncertainty, it’s reassuring to know that you have a ‘rainy day’ pot to fall back on if you need it. But how many of us actually have adequate savings at the moment? And who’s the best (and worst) at saving money? To find out, the savings comparison site Raisin conducted a study of 2,000 UK adults.

The key findings were as follows:

- The average savings of a person in the UK is £9,633.30.

- Men have almost double (£13,140.61) the average savings of women (£6,869.84)

- The lowest average savings in the UK are found in the East Midlands (£6,438.48) followed closely by Northern Ireland (£6,710.00)

- Londoners have by far the highest average savings with £28,978.40. This is more than double second placed West Midlands (£13,318.35)

- Almost 1 in 5 of those aged 55 or over (in or approaching retirement age) has just £1000 or less in savings

When asked “How much, to the nearest pound, do you have in your savings account(s) today?”

848 of the 2,000 respondents said they would rather not answer the question.

Out of the 1,152 people left over, the following answers were given:

- 6.5% say they have no savings whatsoever

- 26% have less than £1,000 saved up

- Using the Trimmean mean taking the middle 66% of responses to give a realistic viewpoint, the average savings of a person in the UK is £9,633.30

Who Saves Better Men or Women?

- Women’s average savings are £6,869.84

- Men have almost double with £13,140.61

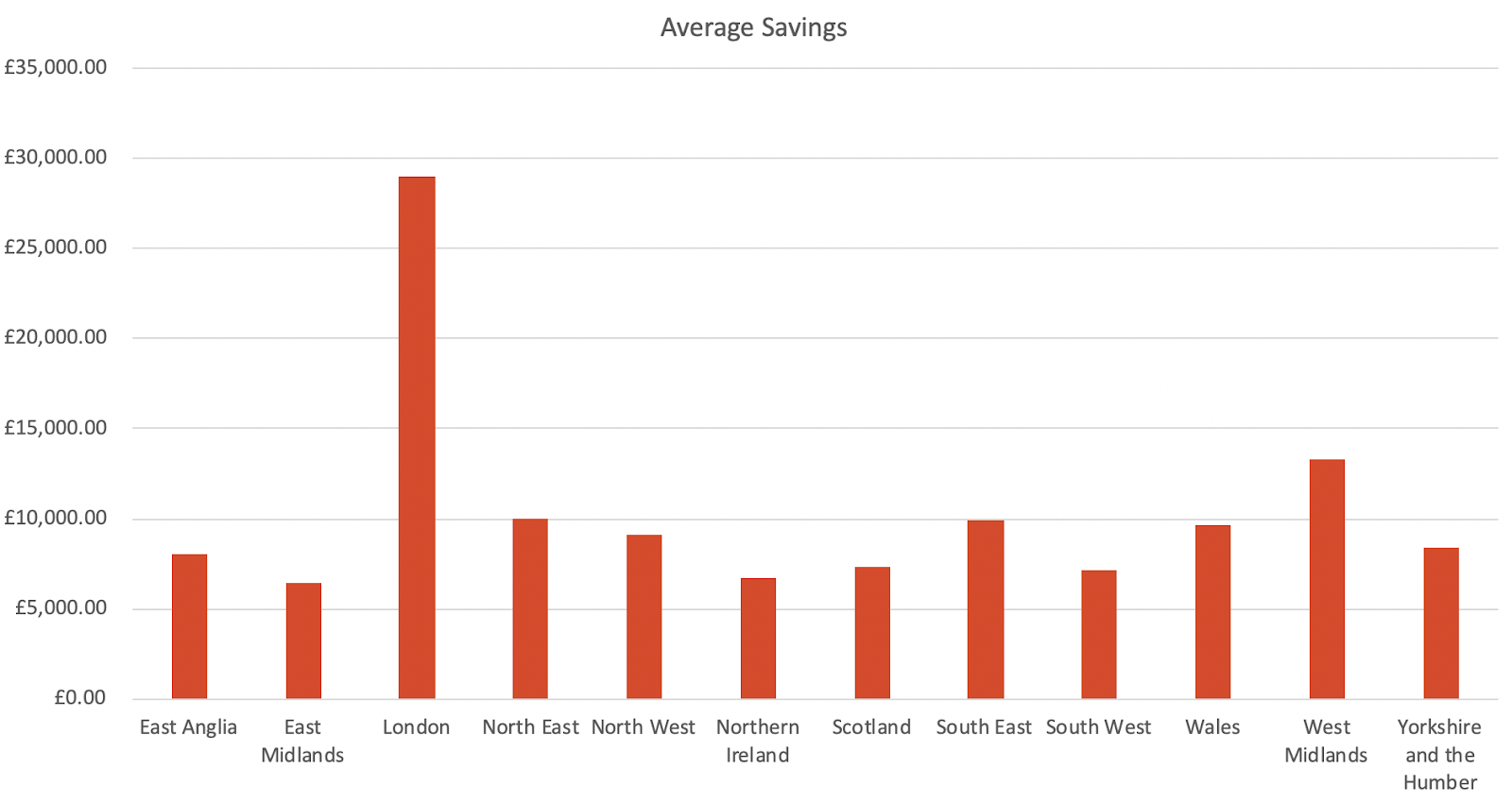

Regional Variations

Those living in London have more than 4 times the savings of those living in the East Midlands.

- The lowest average savings in the UK are found in the East Midlands (£6,438.48) followed closely by Northern Ireland (£6,710.00)

- London has the highest average savings by far with £28,978.40. This is more than double second placed West Midlands (£13,318.35)

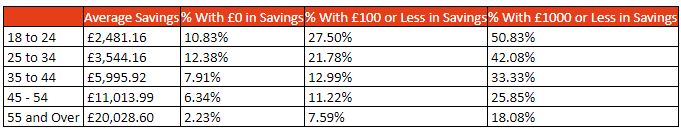

Age Variations

We found generally, as we’d expect, that those in older age groups tend to have more savings:

Are we Retirement Ready?

Looking at savings alone, unfortunately, it seems that a lot of people of retirement age are not financially ready for retirement.

Almost 1 in 5 of those aged 55 or over has less than £1,000 of savings.

The average savings amongst the 55 and overs is almost double that of the 45 to 54s and is more than double the national average. But £20,028.60, the average savings of someone over 55 in the UK, is less than the national mean salary of a full time employee (£28,677 according to the most recent Government data).

It’s important to note that these findings don’t take into account other assets (such as properties or businesses) people may own. However they do represent a large proportion of those who are approaching retirement age who don’t have significant savings to rely on.

Contacts