Lafayette Is A Different Kind Of City

LAFAYETTE, CALIF. / AGILITYPR.NEWS / August 16, 2024 / Lafayette, Calif. When Lafayette was incorporated in 1968, it was established as A Different Kind of Cityfocused on providing essential services without levying property taxes. While other cities and county agencies imposed property taxes at different rates, the City of Lafayette did not. As a result, the City's municipal operations were mainly funded by minimal sales tax receipts.

In 1978, Proposition 13 passed, significantly changing property taxation. This new legislation standardized a property tax rate at 1% of the assessed value for all California property owners – this is called the “Countywide Tax.” However, since Lafayette had not previously levied local property taxes, the City did not receive any distribution from this property tax.

“However, ten years later, in 1988, the City began receiving a small portion of the Countywide tax following acknowledgment by the California State Legislature that the City was not allocated a "fair share” of property taxes being paid by Lafayette residents," explained City Manager Niroop K. Srivatsa. Even so, today, the City only receives 6.7% of the Countywide Tax, while other cities in Contra Costa County get anywhere from 5.4% to 27.7%.

The City has remained focused on providing

police, public works, planning, and parks

services and programs to residents in an efficient and relatively low-cost fashion.

For example - The City uses contractors for specific jobs rather than full-time City employees. “We competitively contract for street and sidewalk repairs, traffic signal maintenance, roadway striping and stenciling, and downtown median landscaping, explains Srivatsa. “The orange-shirted workers you see tending to the plants and changing the banners downtown are contract employees.”

The City also engages contract employees for recreation instruction and law enforcement. “This policy ensures the most advantageous combination of cost, quality, and adaptability, the City Manager adds.

The smaller workforce, relative to other cities of similar size, not only helps to control costs but also fosters a more personal, collegial, and cooperative council-staff relationship. As a result, the staff decided to forgo joining a union and instead engages directly with the City Council, facilitated by the City Manager, to address pay and benefits.

Lafayette employees participate in a 401-style defined contribution plan. “We offer a fair and reasonable retirement plan for our dedicated public servants while ensuring the City's financial stability. As a result, due to the absence of a defined-benefit pension plan that is common in most other cities, Lafayette does not have significant long-term unfunded pension obligations except for providing a limited retirement health benefit for retiring employees. We have worked with an actuary and the City’s independent auditor to ensure that the liability for that program is on track to be fully funded,” City Manager Srivatsa points out.

Lafayette takes pride in maintaining minimal debt and is on track to fully pay off the bonds that financed road repairs by 2026. Over the years, the tax rate for that bond has decreased consistently from $19 per $100K of assessed value to just over $4 per $100K this year.

In Lafayette, City Council members and Commissioners serve as unpaid volunteers, while in many other cities, Council members are compensated.

For decades, Lafayette had proudly maintained a balanced budget through various strategies. Unfortunately, due primarily to increasing inflationary pressures, the City is now facing mounting operating expenses, a 144% increase in insurance costs, more unfunded state mandates, and years of deferred maintenance for which there are no additional funds.

As a result, the City now faces an annual deficit of more than $2M; thus, without additional revenue, City officials will need to make difficult decisions about which programs and services to potentially eliminate or cut back.

Rather than cut programs immediately without consulting voters, the City Council considered various funding options to generate additional revenues that would minimize the impact on Lafayette residents. They ultimately decided to ask voters to approve a 0.5% increase in the sales tax rate, equivalent to half a penny for every taxable dollar spent locally, for a period of seven years.

“A half-cent increase in sales tax will generate approximately $2.4 million annually,” explained City Manager Srivatsa. “This would be enough to close the budget gap and maintain the current level of services and programs provided to local residents by the City; however, it would not be sufficient to address new or unfunded projects and programs.”

The sales tax is paid by both visitors who dine and shop in Lafayette and by residents. As a result, funds are brought into the community to benefit Lafayette residents by people who reside outside the City. And, 100% of these funds stay in Lafayette and do not have to be shared with the State or other entities.

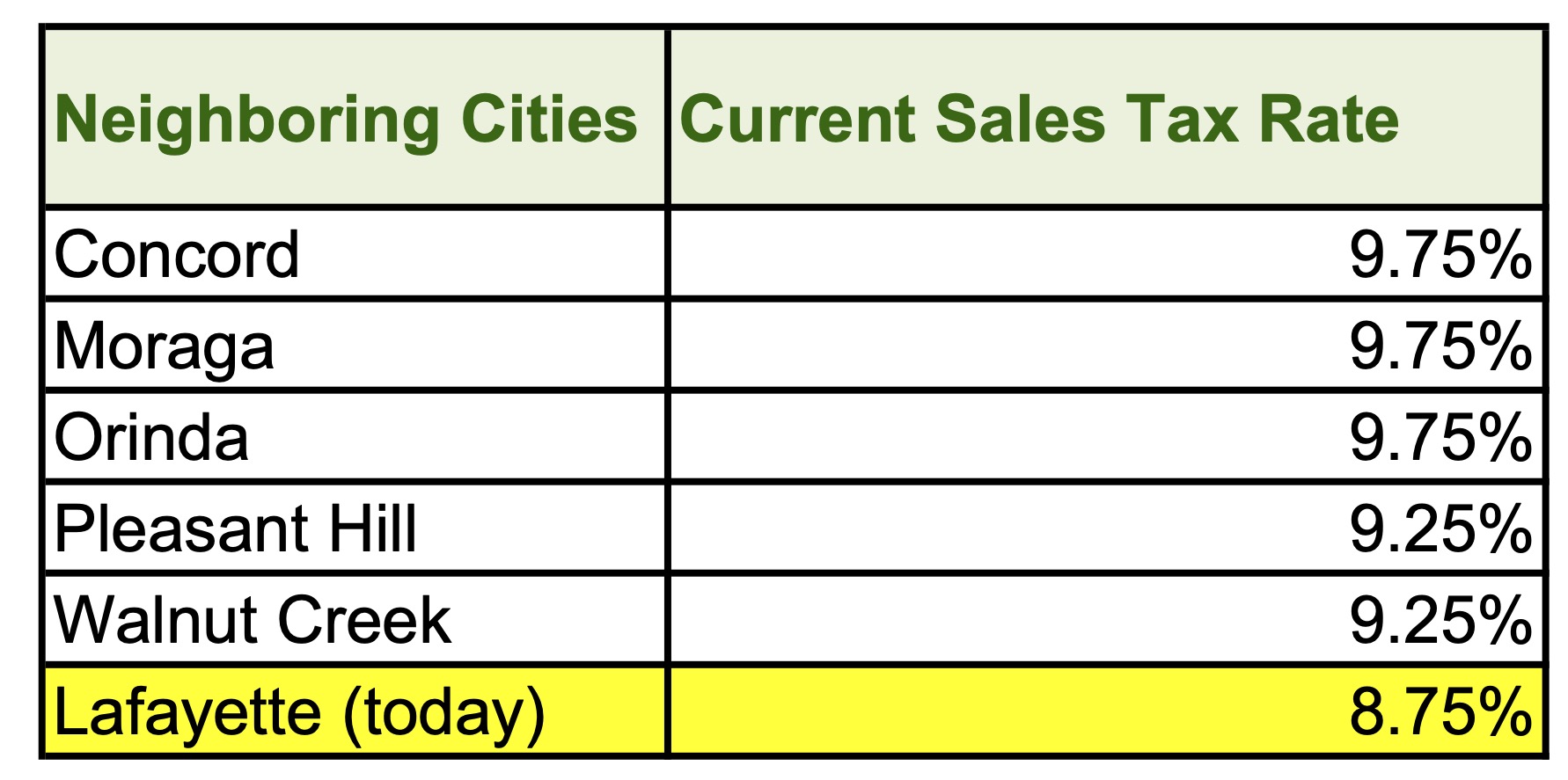

If authorized by Lafayette voters, the sales tax rate in Lafayette will increase from 8.75% to 9.25%, less than the rates in Moraga and Orinda.

Measure H will appear on the November 5, 2024, ballot for Lafayette voters to consider. Passage requires simply-majority support (50%, plus one vote); Revenues from the measure will be placed into the City’s General Fund. The City Council will appoint an Oversight Committee to monitor how these monies are spent and there will be an annual audit, which will be made available to the public.

The City Manager concludes, “The City's initial mission statement was centered on simplicity, a core element that continues to be deeply embedded in the City's vision. Our aim is to sustain the continuity of existing services and programs sought by residents while also upholding fiscal responsibility."

For more information, email LafayetteListens@LoveLafayette.org, call (925) 299-3206 , or visit www.LoveLafayette.org.

[DM1]There is a far better photo of Niroop; this should be changed out.

Neighboring Cities Current Sales Tax Ratea

Lafayette City Manager Niroop K. Srivatsa.

Lafayette City police officers are contracted through the Contra Costa County Sheriff's Department.

The City of Lafayette places a high priority on preserving the current condition of its streets and storm drains while ensuring that potholes are promptly repaired. Additionally, the City Council's budget is specifically geared toward supporting police, public works, planning, and parks.

Contacts

Tracy

Administrative Services Director

TRobinson@ci.lafayette.ca.usRobinson

Phone: (925) 299-3227

ci.lafayette.ca.us