Proposed Federal Cryptocurrency U.S. Regulatory Oversight Law - H.R. 4763, Financial Innovation and Technology for the 21st Century Act

ORLANDO, FLORIDA / AGILITYPR.NEWS / August 23, 2023 / Federal Cryptocurrency U.S. Regulatory Oversight - Proposed H.R. 4763, Financial Innovation and Technology for the 21st Century Act

Below is an quick overview of H.R. 4763, the Financial Innovation and Technology for the 21st Century Act. The House Committee on Financial Services on July 26, 2023, and the House Committee on Agriculture on July 27, 2023, ordered to be reported to the U.S. House for confirmation of H.R. 4763.

If approved by both the U.S. House and U.S. Senate this act is aimed at introducing significant changes to the regulation of digital assets in the United States. It addresses the current lack of a comprehensive federal regulatory framework specifically tailored to digital assets. One key consideration of crypto regulation that often generates uncertainty in the industry is whether a particular digital asset, given its individual features, should be regulated as a security by the SEC, as a commodity by the CFTC, or both.

CALL TO ACTION - for American policy leaders to collaborate in creating comprehensive and consistent crypto regulations on a global scale. It highlights the challenges posed by emerging market economies adopting cryptocurrencies like stablecoins for currency substitution, which can lead to capital outflows, loss of monetary sovereignty, and financial instability. The key points for a "CALL TO ACTION" include:

- Urgent Legislative Action: Bipartisan policy leaders are urged to work together to swiftly legislate crypto regulatory oversight. The aim is to establish a robust and globally coordinated regulatory framework for cryptocurrencies.

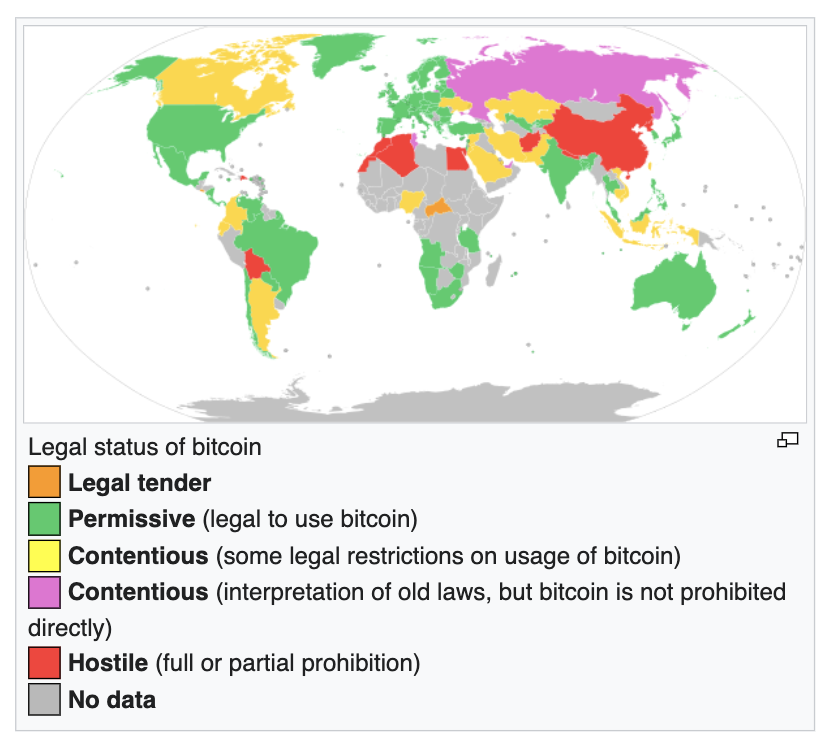

- Emerging Market and Developing Economies: Many countries are already being significantly affected by the risks associated with cryptocurrencies. Some of these nations are turning to crypto assets, particularly dollar-denominated stablecoins, as a way to replace their domestic currencies and bypass exchange and capital controls.

- Challenges Created by Crypto Substitution: The process of substituting domestic currencies with cryptocurrencies, such as stablecoins, can lead to capital leaving the country, loss of control over domestic monetary policies, and potential threats to financial stability. These challenges are seen in countries like Russia.

- Addressing Root Causes: The call to action emphasizes that addressing the root causes of "cryptoization" requires improving trust in domestic economic policies, national currencies, and banking systems. This would reduce the incentive for citizens and businesses to seek alternatives like cryptocurrencies.

- Global Approach Needed: Due to the cross-border nature of cryptocurrencies, uncoordinated national efforts to regulate them may not effectively mitigate systemic risks. A global approach is necessary to establish critical controls, accountability, and transparency in the crypto space.

- Adapting to Changing Landscape: The call to action acknowledges that a successful global crypto regulatory framework requires countries to adapt to evolving risks and scenarios. It emphasizes the importance of working collectively and proactively with other countries.

In essence, this passage advocates for a swift and comprehensive response from American policy leaders to address the challenges posed by the increasing adoption of cryptocurrencies, particularly stablecoins, in both emerging and developed economies. It underscores the need for global cooperation and a unified regulatory approach to ensure financial stability and accountability in the crypto space.

WHY/ STAT: According to CNBC, the best-known cryptocurrency, Bitcoin, had a good year. The digital currency has been up nearly 70 percent since the start of 2021, driving the entire crypto market to a combined $2 trillion in value.

ANALOGY: "If it looks like a duck, walks like a duck and quacks like a duck..." - Gary Gensler from US SEC: "These are the same rules that everyone else in the securities markets has played by for decades." Why not institute same disclosures, have internal controls, conduct audit, provide assurance, conduct attestation, provide insurance AND grow innovation, expand growth potential for future generations/ new technologies/ blockchain/ XBRL/ data tagging/ GLEIF for regulatory oversight?

Here's a breakdown of the key points outlined in the passage:

- Current Regulatory Landscape: Currently, digital assets are subject to various existing laws and regulations depending on their specific features. These may include regulations administered by the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

- Decentralization and Digital Commodities Framework: One of the challenges in regulating digital assets is determining whether a particular asset should be classified as a security by the SEC, a commodity by the CFTC, or both. H.R. 4763 aims to resolve this uncertainty by creating classification criteria for digital assets. It proposes that digital assets running on decentralized blockchains be classified as commodities under the jurisdiction of the CFTC. A decentralized network is defined as one without unilateral authority controlling the blockchain.

- Certification Process: The proposal allows individuals and firms to certify with either the SEC or the CFTC that their digital assets meet the decentralized criteria. The regulatory authorities have the power to reject such certifications under specific circumstances.

- Exclusive CFTC Jurisdiction: By classifying decentralized digital assets as commodities, the bill seeks to give the CFTC new authority. The CFTC would have exclusive jurisdiction over the market for cash or spot market digital commodities. Entities involved in trading digital commodities, such as exchanges and brokers, would need to register with the CFTC.

- Regulation of Offers, Sales, and Intermediaries: H.R. 4763 introduces exemptions from existing securities regulations for qualified digital assets that meet certain criteria. The act establishes disclosure requirements for primary market transactions and imposes new registration and compliance requirements for secondary market transactions conducted on digital asset trading systems and by digital asset broker-dealers.

- Provisional Registration and Other Provisions: The bill establishes a provisional registration process for entities to file notices of intent with the CFTC and SEC. Entities that complete this process would be granted a limited safe harbor from enforcement actions. The bill also includes provisions to accommodate the coexistence of digital securities and commodities frameworks and addresses certain exemptions and joint rulemaking by the SEC and CFTC.

This summary highlights the main aspects of the H.R. 4763 proposal, which aims to provide a more structured regulatory framework for digital assets in the United States. If you have any specific questions or would like further information on any particular aspect, please feel free to contact me. Thank you for your consideration.

Social media:

#cryptocurrency #bitcoin #crypto #blockchain #forex #money #trading

#cryptoexchange #esma #ecb #esef #xbrl #corpgov #sox404 #internalcontrols

#investment #bitcoinmining #systemicrisk #cryptonews #investing #banking

#cryptocurrencies #forextrader #invest #entrepreneur #bitcointrading #trader

#investor #fdicia #bitcoincash #finance #usa #business #entrepreneur #success #money

#investment #millionaire #wealth #invest #fintech #regtech #ai #dataanlaytics

#blockchain #banking #financialservices #currency #forensicaccountant #trading #internalcontrols #cryptocurrency #investing #finance #forextrader #financialfreedom #crypto #investor #drugmoney #blockchain #governance #government #politics #svb

#leadership #internalaudit #esma #forensicaccountant #treasury #ukfca #euparliament #frankfurt #currentaffairs #drugcartel #riskmanagement #ethics

#environment #crime

#compliance #economy #goodgovernance #covid #svb #internationalrelations #ftx

#education #sustainability #putin #innovation #history #auditcommittee

#opengoverment #democracy #sox404 #russia #social #polity #innovation #bsa #esg #csr #fraud #oversight #homelandsecurity #drugmoney #scotlandyard #oecd #ifac #pcaob #usdol #ebsa

#corporategovernance #policy #ransomware #security #law #aml #society #publicinterest

#corpgov #cfo #ceo #board #usdod #director #internalcontrols #materialrisk #madoff #accounting #sec_news #ponzischeme #ima #pryamid #svb #gambling #eu #ukraine #taxes #fbi #interpol #ima_news #audit #attestation #fintech #regtech #govtech #accountability

#transparency #aml #bsa #humantrafficking #childlabor #abaesq #employmentlaw #bank #personalfinance #supplychain #usdoj #gleif #lei #stocks #coinbase #xrp #forextrading #dogecoin #binaryoptions #bitcoinprice #cryptoworld #cryptoinvestor #forexsignals #stockmarket #altcoin #hodl #nfts #ripple #motivation #cryptoart #success #blockchaintechnology #cryptomining #wealth #nftart #usgao #mining #cybersecurity #binary #firstrepublic #altcoins #financialfreedom #trade #art #usa #forexlifestyle #crypto #usa #business #entrepreneur #cryptotax #success #money #bitcoin #forex #investment #millionaire #wealth #invest #trading #cryptocurrency #investing #ifc #finance #forextrader #financialfreedom #investor #blockchain #cia #altcoin #usdol #bitcoinexchange #fdic #dogecoin #altcoins #blockchaintechnology #cryptoworld #cryptomining #cryptocurrencynews #cryptomarket #cryptomemes #cryptolife #cryptotrader #cryptos #cryptocurrencytrading #cryptotrade #cryptozoology #cryptomeme #cryptoexchange #cryptocurrencies #cryptotrading #cryptonews #cryptoworld #cryptomining #cryptocurrencynews #cryptomarket #cryptomemes #cryptolife #cryptotrader #cryptos #cryptocurrencytrading #cryptotrade #cryptozoology #cryptoexchange #cryptomoney #cryptocoin

About Us

ABOUT COLCOMGROUP

Accomplished business development, government affairs, media relations, strategic relations, marketing, branding and communications executive with experience in accounting, legal, consumer goods, financial services, technology and professional services sectors.

Counsel clients in variety of areas: global private placement advisory services, capital fundraising, debt/equity financing, sponsorship, CSR/ESG advisory services, LGBTQ diversity, equity and inclusion, strategic planning, new product development, product launches, direct marketing, collateral and advertising design, copy writing/writing, speech writing, business plan/marketing plan/communications plan development, product/service positioning and branding, media relations, government affairs, media training, message point development, image management, new business development, and strategic partner development/third party outreach. Cancer survivor and advocate.

We speak regularly to professionals on marketing and communications topics. Specialties include:

- Media Relations

- Marketing

- Branding

- Positioning

- Business Development

- Government Affairs

- Message Development

- Image Management

- Issues Management

- Strategic Planning

- Product Development

- Product Launches

- Strategic Partner Development

- Human Capital / Diversity, Equity and Inclusion

- LGBTQ Diversity, Equity and Inclusion

- Cybersecurity

- Cryptocurrency

- Forensic Accounting

- White Collar Crime Issue

- Sponsorship Sales

- Membership Marketing

- Human Capital Disclosures

- Financial & Non-Financial Reporting Standards

- ESG Corporate Disclosures - Climate / Human Capital

- CPE Marketing

- Big Data/ Data Analytics

- iXBRL

- Crowd Funding/Sourcing

Contacts

David Colgren

CEO, Colcomgroup, Inc.

dcolgren@colcomgroup.comPhone: 917-587-3708

https://www.linkedin.com/in/davidcolgren/